Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

407.1. Assume a corporate bond with a face value of $1,000 that pays a semi-annual coupon (coupons pay January and July 1st) with a 12.0% coupon rate. The bond settles on June 13th, 2014 and matures, more than six years later, on July 1st, 2020. At the current traded price, the bond's yield (YTM) is 10.0%. Which is NEAREST to the bond's quoted (aka, clean) price? (Hint: the TI BA II+ calculator only computes a full/dirty price so you need to compute the full price at that last coupon date, compound the price forward to the settlement date and infer the quoted price from this full price at settlement.)

a. $975

b. $1,089

c. $1,107

d. $1,143

407.2. Your colleague Peter is comparing two investments, either of which require an initial cash outlay of $1,000:

a. The Eurodollar futures contract produces a higher annualized continuously compounded return

b. The two investments produce identical annualized continuously compounded returns

c. The US Treasury bill investment produces a higher annualized continuously compounded return

d. It is unclear as a key piece of information is omitted

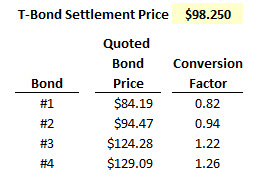

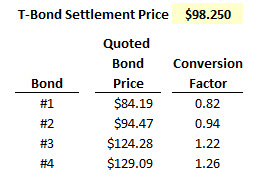

407.3. Suppose the Treasury bond futures settlement price is $98.250 and there are four bonds eligible for delivery, as listed below:

Which bond is the cheapest to deliver (CTD)?

a. Bond #1

b. Bond #2

c. Bond #3

d. Bond #4

Answers here:

Questions:

407.1. Assume a corporate bond with a face value of $1,000 that pays a semi-annual coupon (coupons pay January and July 1st) with a 12.0% coupon rate. The bond settles on June 13th, 2014 and matures, more than six years later, on July 1st, 2020. At the current traded price, the bond's yield (YTM) is 10.0%. Which is NEAREST to the bond's quoted (aka, clean) price? (Hint: the TI BA II+ calculator only computes a full/dirty price so you need to compute the full price at that last coupon date, compound the price forward to the settlement date and infer the quoted price from this full price at settlement.)

a. $975

b. $1,089

c. $1,107

d. $1,143

407.2. Your colleague Peter is comparing two investments, either of which require an initial cash outlay of $1,000:

- A long position in one (1) Eurodollar futures contract with initial quote of 97.00. The contract is closed 90 days later, after the quoted price will have increased to 97.50 (i.e., he is going to assume he knows this). The initial margin is $1,000 per contract. To simplify his calculations, he will assume no interim cash flows: although this futures contract would settle daily, his calculation will assume neither margin calls nor interim excess margin withdrawals.

- The cash purchase of $1,000 worth of 90-day US Treasury bills with an initial quote of 6.00. Note the face value of this purchase will be greater than $1,000 as the US Treasury bill is a so-called discount instrument.

a. The Eurodollar futures contract produces a higher annualized continuously compounded return

b. The two investments produce identical annualized continuously compounded returns

c. The US Treasury bill investment produces a higher annualized continuously compounded return

d. It is unclear as a key piece of information is omitted

407.3. Suppose the Treasury bond futures settlement price is $98.250 and there are four bonds eligible for delivery, as listed below:

Which bond is the cheapest to deliver (CTD)?

a. Bond #1

b. Bond #2

c. Bond #3

d. Bond #4

Answers here: