Learning Objectives: Explain the concept of net asset value (NAV) of an open-end mutual fund and how it relates to share price. Explain the key differences between hedge funds and mutual funds. Calculate the return on a hedge fund investment and explain the incentive fee structure of a hedge fund, including the terms hurdle rate, high-water mark, and clawback.

Questions:

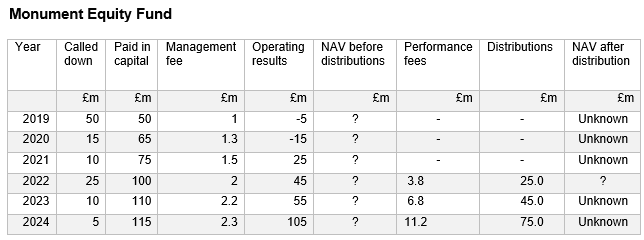

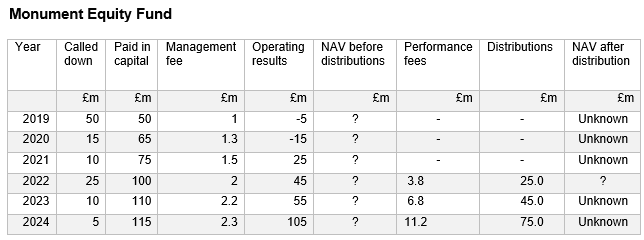

24.1.1. An investment manager evaluating funds for his clients encounters incomplete data for the Monument Equity Fund. The missing Net Asset Values (NAVs) for several years complicate his analysis, especially for the year 2022.

Units at the end of 2022: 1,000,000.

Which of the following most closely matches the per-unit price of this fund at the end of 2022?

a. £115.4 per unit

b. £144.2 per unit

c. £100 per unit

d. £290 per unit

24.1.2. During a client consultation, Rudolf Roger, CFA, a private investment advisor, discusses fund options with a client interested in a high-return investment strategy. One of the options is a fund that requires investors to have a minimum net worth of $20 million and engages in strategies similar to other funds but with 100 times the leverage.

Excited by the prospect but lacking the necessary capital to invest directly, the client asks, "Rudolf, this fund makes similar investments to the ones we've discussed before, but it's 100 times leveraged. Do you think it's a good idea, considering I don't have enough capital to start with?"

What would be the best answer from Rudolf in this case?

a. Hedge funds, including this leveraged fund, require accredited investors due to their high-risk strategies and limited regulatory oversight, which may not be suitable for the client's financial status.

b. Unlike mutual funds, hedge funds may have significant entry requirements, such as a high minimum net worth, which could exceed the client's current financial capability.

c. The leverage in hedge funds significantly increases investment risk, which may not align with the client's risk tolerance or investment experience.

d. Hedge funds often employ aggressive strategies that may lead to substantial losses, potentially unsuitable for someone without significant investment capital or experience.

24.1.3. An analyst at a hedge fund is reviewing incentive fees accrued over the past two years. The hedge fund’s policy is to compute management fees annually based on the fund's asset value at the year's start. Here is the pertinent data:

*Management fee is applied on the NAV after taking annual growth into account.

**Incentive fees will be assessed on the end-of-year NAV, after deducting the management fee.

Based on the above, which estimate is closest to the total incentive fees collected by the hedge fund during this period?

a. $274 million

b. $428.8 million

c. $486 million

d. $608.1 million

Answers here:

Questions:

24.1.1. An investment manager evaluating funds for his clients encounters incomplete data for the Monument Equity Fund. The missing Net Asset Values (NAVs) for several years complicate his analysis, especially for the year 2022.

Units at the end of 2022: 1,000,000.

Which of the following most closely matches the per-unit price of this fund at the end of 2022?

a. £115.4 per unit

b. £144.2 per unit

c. £100 per unit

d. £290 per unit

24.1.2. During a client consultation, Rudolf Roger, CFA, a private investment advisor, discusses fund options with a client interested in a high-return investment strategy. One of the options is a fund that requires investors to have a minimum net worth of $20 million and engages in strategies similar to other funds but with 100 times the leverage.

Excited by the prospect but lacking the necessary capital to invest directly, the client asks, "Rudolf, this fund makes similar investments to the ones we've discussed before, but it's 100 times leveraged. Do you think it's a good idea, considering I don't have enough capital to start with?"

What would be the best answer from Rudolf in this case?

a. Hedge funds, including this leveraged fund, require accredited investors due to their high-risk strategies and limited regulatory oversight, which may not be suitable for the client's financial status.

b. Unlike mutual funds, hedge funds may have significant entry requirements, such as a high minimum net worth, which could exceed the client's current financial capability.

c. The leverage in hedge funds significantly increases investment risk, which may not align with the client's risk tolerance or investment experience.

d. Hedge funds often employ aggressive strategies that may lead to substantial losses, potentially unsuitable for someone without significant investment capital or experience.

24.1.3. An analyst at a hedge fund is reviewing incentive fees accrued over the past two years. The hedge fund’s policy is to compute management fees annually based on the fund's asset value at the year's start. Here is the pertinent data:

- Management fee rate: 2% annually*

- Incentive fee rate: 20%**

- Fund asset value at the start of the first year: $5 billion

- Asset growth in the first year: 30%

- Asset growth in the second year:15%

*Management fee is applied on the NAV after taking annual growth into account.

**Incentive fees will be assessed on the end-of-year NAV, after deducting the management fee.

Based on the above, which estimate is closest to the total incentive fees collected by the hedge fund during this period?

a. $274 million

b. $428.8 million

c. $486 million

d. $608.1 million

Answers here: