Learning objectives: Calculate covariance using the EWMA and GARCH(1,1) models. Apply the consistency condition to covariance. Describe the procedure of generating samples from a bivariate normal distribution. Describe properties of correlations between normally distributed variables when using a one-factor model.

Questions:

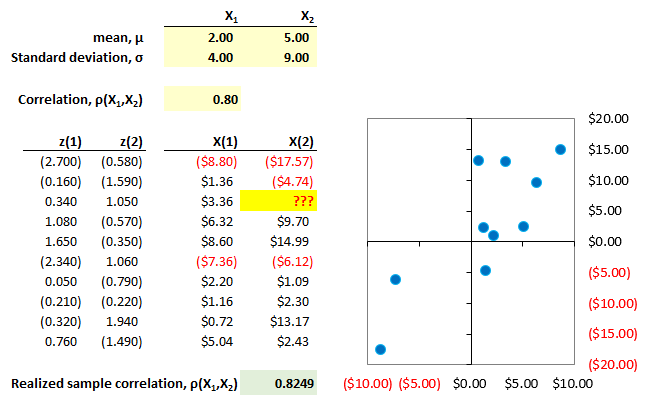

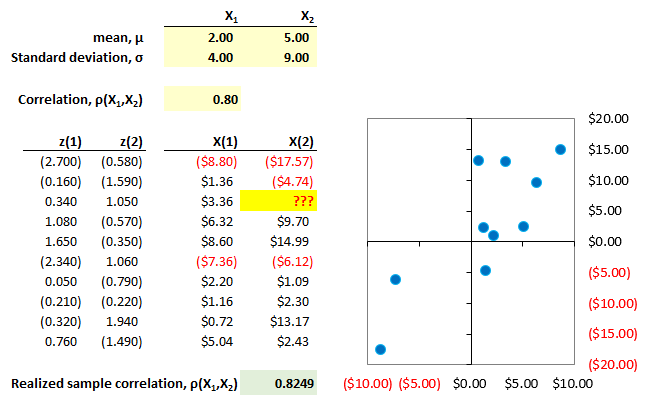

706.1. The data and plot below show a bivariate normal sample distribution. The first two columns, z(1) and z(2), display random standard normal variables, N(0,1). Because X(1) is a (non-standard) random normal variable with mean, µ, of 2.0 and standard deviation, σ, of 4.0, it is given by X(1) = 2.0 + 4.0 * z(1). On the other hand, X(2) is correlated with X(1) according to the selected correlation parameter, ρ(X1, X2), of 0.80.

What is the missing third realization ("???") of X(2)?

a. -1.27

b. +3.03

c. +8.50

d. +13.12

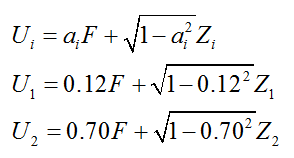

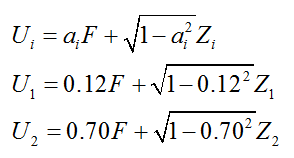

706.2. The general single-factor model below, given by U(i), characterizes both U(1) and U(2) which are both dependent on a common factor, (F):

What is the coefficient of correlation between U(1) and U(2)?

a. -0.4900

b. +0.0840

c. +0.5044

d. +0.8200

706.3. Yesterday's volatility, σ(n-1), and the return data for two assets is shown below:

Yesterday's correlation,ρ(A,B), between the asset was 0.50. If we assume a lambda, λ, parameter of 0.850, which is nearest to the updated correlation between the two assets if we use an exponentially weighted moving average (EWMA) model to update the correlation?

a. 0.500

b. 0.533

c. 0.600

d. 0.731

Answers here:

Questions:

706.1. The data and plot below show a bivariate normal sample distribution. The first two columns, z(1) and z(2), display random standard normal variables, N(0,1). Because X(1) is a (non-standard) random normal variable with mean, µ, of 2.0 and standard deviation, σ, of 4.0, it is given by X(1) = 2.0 + 4.0 * z(1). On the other hand, X(2) is correlated with X(1) according to the selected correlation parameter, ρ(X1, X2), of 0.80.

What is the missing third realization ("???") of X(2)?

a. -1.27

b. +3.03

c. +8.50

d. +13.12

706.2. The general single-factor model below, given by U(i), characterizes both U(1) and U(2) which are both dependent on a common factor, (F):

What is the coefficient of correlation between U(1) and U(2)?

a. -0.4900

b. +0.0840

c. +0.5044

d. +0.8200

706.3. Yesterday's volatility, σ(n-1), and the return data for two assets is shown below:

Yesterday's correlation,ρ(A,B), between the asset was 0.50. If we assume a lambda, λ, parameter of 0.850, which is nearest to the updated correlation between the two assets if we use an exponentially weighted moving average (EWMA) model to update the correlation?

a. 0.500

b. 0.533

c. 0.600

d. 0.731

Answers here: