Learning outcomes: Apply Bayes’ theorem to scenarios with more than two possible outcomes.

Questions:

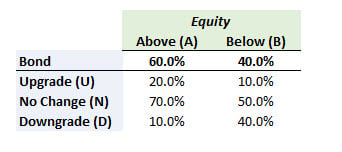

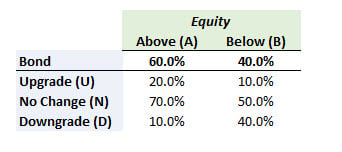

501.1. As a risk analyst, you are asked to look at Whitetech Corporation, which has issued both equity and bonds. The bonds can either be downgraded, be upgraded, or have no change in rating. The stock can either perform above the market, with unconditional probability of 60.0%, or below the market with unconditional probability of 40.0%. If the equity performs above the market, there is a 20.0% probability of a bond upgrade; P[U|A] = 20.0%. If the equity performs below the market, there is only a 10.0% probability of a bond upgrade; P[U|B] = 10.0%.

If the bond was upgraded, what is the probability that the equity finished the period below the benchmark; i.e., Prob [B|U] ?

a. 4.0%

b. 10.0%

c. 25.0%

d. 50.0%

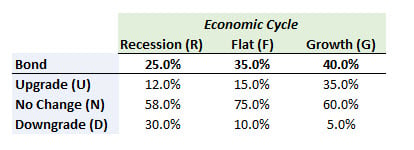

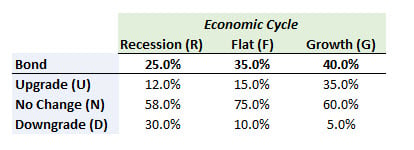

501.2. As a risk analyst, you are asked to analyze the bonds of Ganztrax Corporation in the context of economic cycles. The economic cycle can be in one of three states: recession, flat or growth. The corresponding unconditional probabilities are P[R] = 25.0%, P[F] = 35.0%, and P[G] = 40.0%. If the economy is in a growth cycle, then the bond can be either upgraded, downgraded, or unchanged; the corresponding conditional probabilities are P[U|G] = 35.0%, P[N|G] = 60.0% and P[D|G] = 5.0%.

If the bond was downgraded, which is nearest to the probability that the economy is in a growth cycle; i.e., Prob[G|D] ?

a. 2.0%

b. 9.5%

c. 13.0%

d. 15.4%

501.3. Your firm is testing a new quantitative strategy. The analyst who developed the strategy claims that there is a 60.0% probability that the strategy will generate positive returns on any given day. After 30 trading days the strategy has generated a profit 21 times, which is fully 70.0%. Assume that there are only two possible states of the world: Either the analyst is correct, or there the strategy is equally likely to gain or lose money on any given day. Your prior assumption was that these two states of the world were equally likely. Which is nearest to the probability that the analyst is right and the actual probability of positive returns for the strategy is 60%? (Please note: this question is not exam-realistic because it requires spreadsheet/software to retrieve binomial probabilities. Source: variation on Miller 6-4).

a. 60.0%

b. 74.3%

c. 86.1%

d. 90.5%

Answers here:

Questions:

501.1. As a risk analyst, you are asked to look at Whitetech Corporation, which has issued both equity and bonds. The bonds can either be downgraded, be upgraded, or have no change in rating. The stock can either perform above the market, with unconditional probability of 60.0%, or below the market with unconditional probability of 40.0%. If the equity performs above the market, there is a 20.0% probability of a bond upgrade; P[U|A] = 20.0%. If the equity performs below the market, there is only a 10.0% probability of a bond upgrade; P[U|B] = 10.0%.

If the bond was upgraded, what is the probability that the equity finished the period below the benchmark; i.e., Prob [B|U] ?

a. 4.0%

b. 10.0%

c. 25.0%

d. 50.0%

501.2. As a risk analyst, you are asked to analyze the bonds of Ganztrax Corporation in the context of economic cycles. The economic cycle can be in one of three states: recession, flat or growth. The corresponding unconditional probabilities are P[R] = 25.0%, P[F] = 35.0%, and P[G] = 40.0%. If the economy is in a growth cycle, then the bond can be either upgraded, downgraded, or unchanged; the corresponding conditional probabilities are P[U|G] = 35.0%, P[N|G] = 60.0% and P[D|G] = 5.0%.

If the bond was downgraded, which is nearest to the probability that the economy is in a growth cycle; i.e., Prob[G|D] ?

a. 2.0%

b. 9.5%

c. 13.0%

d. 15.4%

501.3. Your firm is testing a new quantitative strategy. The analyst who developed the strategy claims that there is a 60.0% probability that the strategy will generate positive returns on any given day. After 30 trading days the strategy has generated a profit 21 times, which is fully 70.0%. Assume that there are only two possible states of the world: Either the analyst is correct, or there the strategy is equally likely to gain or lose money on any given day. Your prior assumption was that these two states of the world were equally likely. Which is nearest to the probability that the analyst is right and the actual probability of positive returns for the strategy is 60%? (Please note: this question is not exam-realistic because it requires spreadsheet/software to retrieve binomial probabilities. Source: variation on Miller 6-4).

a. 60.0%

b. 74.3%

c. 86.1%

d. 90.5%

Answers here: