Learning objectives: Explain the use of antithetic and control variates in reducing Monte Carlo sampling error. Describe the bootstrapping method and its advantage over Monte Carlo simulation. Describe pseudo-random number generation. Describe situations where the bootstrapping method is ineffective. Describe the disadvantages of the simulation approach to financial problem solving.

Questions:

21.6.1. The code snippet below estimates the value of a call option with Monte Carlo simulation (MCS) where the sample size, n = 10,000. However, this code attempts to improve on the standard MCS by generating a second random variable, U2 which is given by U2 = 1 - U1 where both are uniform random variables. The function qnorm(U1) executes an inverse transformation: Z1 and Z2 are random standard normal cumulative distribution functions (CDFs).

Which statement about this approach is TRUE?

a. This is a successful attempt to employ an antithetic variate because its standard error will be lower than standard n = 10,000 MCS

b. This is a failed attempt to employ antithetic variates because the pairs of random variables are uncorrelated

c. This is a successful attempt to employ control variates because the analytical (aka, closed-form) option price informs the error bias

d. This is neither an attempt to employ antithetic variate nor a control variate

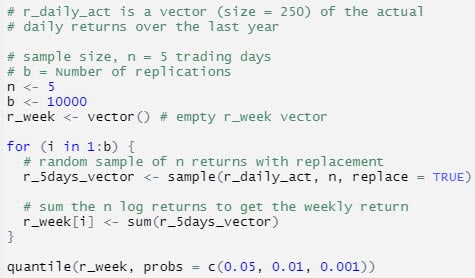

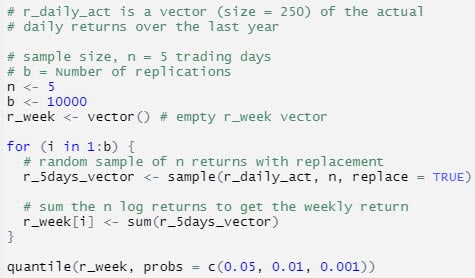

21.6.2. The following code snippet generates a bootstrap sample in order to estimate a portfolio's potential losses (i.e., loss quantiles) over the next week which is five cumulative trading days.

The code assumes a vector of the history of last year's (n = 250) actual daily returns, r_daily_act. The sample(r_daily_act, n, replace = TRUE) function samples from the vector with replacement. In regard to this bootstrap, each of the following is true EXCEPT which is false?

a. This bootstrap procedure is non-parametric because it does not specify a statistical (aka, parametric) distribution

b. Like (in common with) the Monte Carlo simulation, this bootstrap depends on a uniform pseudo-random number generator (PRNG)

c. As an iid bootstrap this procedure reflects an assumption that the returns observations are independent over time, but we could conduct a circular block bootstrap (CCB) if the returns are dependent over time

d. An advantage of this bootstrap is that it will generate some daily losses that exceed the worst daily loss in the actual sample, but the Monte Carlo simulation (MCS) data generating process (DGP) cannot generate daily losses that did not occur in the actual sample; i.e., MCS DGP suffers the Black Swan problem but this bootstrap does not

21.6.3. Robert seeks to price an exotic path-dependent option, call it Price(E), but there exists no analytical solution available to value such a derivative. Of course, Robert does have a Black-Scholes option pricing model (BSM OPM). His BSM OPM is a closed-form solution but it will only price a vanilla option; e.g., European or non-path-dependent. Let's refer to the analytical price of this vanilla option as BSM(V).

He employs a Monte Carlo simulation (MCS) to estimate the price of his exotic, path-dependent option, call this price MCS(E). In this MCS, he generates M sample paths of the future stock price in order to compute M sample payoffs and retrieves the discounted mean to obtain an estimate of the exotic option's value. Further, he re-uses the same simulated sample paths to inform a simulated value of the vanilla option, call this MCS(V). To summarize, in regard to his vanilla option, he has estimates for both an analytical and simulated price, BSM(V) and MCS(V). In regard to his exotic option, he is not able to estimate BSM(E) but he has generated MCS(E).

He has now retrieved both a simulated and analytical price for the vanilla option; this difference is given by BSM(V) - MCS(V). He applies this error to revised his estimate of the exotic option per the following:

Price(E) = MSC(E) + β*[BSM(V) - MCS(V)]

Bob's goal of course is to improve the accuracy of his estimate, as evidenced by a reduction in the variance. A good control variate should have two properties. One is that it should be inexpensive to construct, and this control variate meets that test. What is the other property that Bob seeks?

a. High correlation between Price(E) and BSM(V)

b. An analytical function for the price of the path-dependent option, Price(X)

c. A random number generator (RNG) that is neither pseudo-random nor deterministic but genuinely random

d. A second set of random variables that by construction have a negative correlation with the iid variables used in the simulation

Answers here:

Questions:

21.6.1. The code snippet below estimates the value of a call option with Monte Carlo simulation (MCS) where the sample size, n = 10,000. However, this code attempts to improve on the standard MCS by generating a second random variable, U2 which is given by U2 = 1 - U1 where both are uniform random variables. The function qnorm(U1) executes an inverse transformation: Z1 and Z2 are random standard normal cumulative distribution functions (CDFs).

Which statement about this approach is TRUE?

a. This is a successful attempt to employ an antithetic variate because its standard error will be lower than standard n = 10,000 MCS

b. This is a failed attempt to employ antithetic variates because the pairs of random variables are uncorrelated

c. This is a successful attempt to employ control variates because the analytical (aka, closed-form) option price informs the error bias

d. This is neither an attempt to employ antithetic variate nor a control variate

21.6.2. The following code snippet generates a bootstrap sample in order to estimate a portfolio's potential losses (i.e., loss quantiles) over the next week which is five cumulative trading days.

The code assumes a vector of the history of last year's (n = 250) actual daily returns, r_daily_act. The sample(r_daily_act, n, replace = TRUE) function samples from the vector with replacement. In regard to this bootstrap, each of the following is true EXCEPT which is false?

a. This bootstrap procedure is non-parametric because it does not specify a statistical (aka, parametric) distribution

b. Like (in common with) the Monte Carlo simulation, this bootstrap depends on a uniform pseudo-random number generator (PRNG)

c. As an iid bootstrap this procedure reflects an assumption that the returns observations are independent over time, but we could conduct a circular block bootstrap (CCB) if the returns are dependent over time

d. An advantage of this bootstrap is that it will generate some daily losses that exceed the worst daily loss in the actual sample, but the Monte Carlo simulation (MCS) data generating process (DGP) cannot generate daily losses that did not occur in the actual sample; i.e., MCS DGP suffers the Black Swan problem but this bootstrap does not

21.6.3. Robert seeks to price an exotic path-dependent option, call it Price(E), but there exists no analytical solution available to value such a derivative. Of course, Robert does have a Black-Scholes option pricing model (BSM OPM). His BSM OPM is a closed-form solution but it will only price a vanilla option; e.g., European or non-path-dependent. Let's refer to the analytical price of this vanilla option as BSM(V).

He employs a Monte Carlo simulation (MCS) to estimate the price of his exotic, path-dependent option, call this price MCS(E). In this MCS, he generates M sample paths of the future stock price in order to compute M sample payoffs and retrieves the discounted mean to obtain an estimate of the exotic option's value. Further, he re-uses the same simulated sample paths to inform a simulated value of the vanilla option, call this MCS(V). To summarize, in regard to his vanilla option, he has estimates for both an analytical and simulated price, BSM(V) and MCS(V). In regard to his exotic option, he is not able to estimate BSM(E) but he has generated MCS(E).

He has now retrieved both a simulated and analytical price for the vanilla option; this difference is given by BSM(V) - MCS(V). He applies this error to revised his estimate of the exotic option per the following:

Price(E) = MSC(E) + β*[BSM(V) - MCS(V)]

Bob's goal of course is to improve the accuracy of his estimate, as evidenced by a reduction in the variance. A good control variate should have two properties. One is that it should be inexpensive to construct, and this control variate meets that test. What is the other property that Bob seeks?

a. High correlation between Price(E) and BSM(V)

b. An analytical function for the price of the path-dependent option, Price(X)

c. A random number generator (RNG) that is neither pseudo-random nor deterministic but genuinely random

d. A second set of random variables that by construction have a negative correlation with the iid variables used in the simulation

Answers here:

Last edited by a moderator: