Learning objectives: Describe properties of well-diversified portfolios and explain the impact of diversification on the residual risk of a portfolio. Explain how to construct a portfolio to hedge exposure to multiple factors. Describe and apply the Fama-French three factor model in estimating asset returns.

Questions:

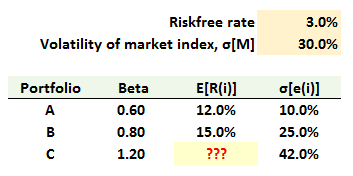

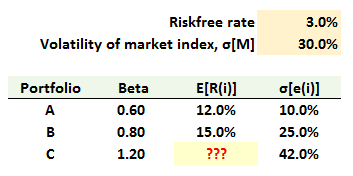

705.1. In a single-factor economy, each of the following portfolios (A, B, and C) is well-diversified:

You discover there is NOT an arbitrage strategy among these three portfolios. In this case, what should be the expected return of Portfolio (C)?

a. 13.3%

b. 16.3%

c. 18.5%

d. 21.0%

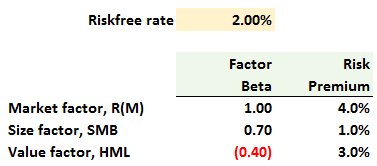

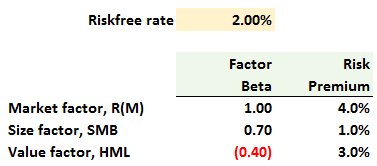

705.2. Assume a sock's returns are accurately characterized by the Fama-French three-factor model. The stock's own factor betas and the risk model's risk premiums are given below:

What is the firm's size/value style characteristics and what is the firm's required rate of return?

a. Small-cap, growth-oriented with a required return of 5.50%

b. Small-cap, value-oriented with a required return of 6.00%

c. Large-cap, growth-oriented with a required return of 3.50%

d. Large-cap, value-oriented with a required return of 8.00%

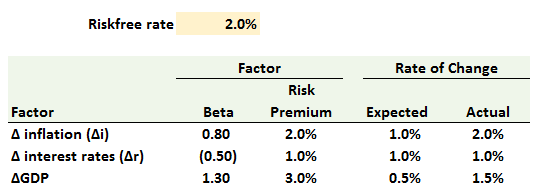

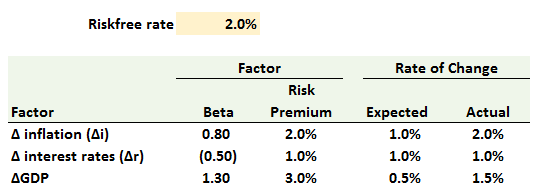

705.3. Consider below the multifactor (APT) model of security returns for a particular stock. In addition to factor betas and risk premiums, two of the factors experience "surprises." Specifically, while interest rates change as expected, actual inflation is +2.0% (compared to expected +1.0%) and actual GDP growth is +1.5% (compared to expected +0.5%):

What is the expected rate of return on the security?

a. 6.8%

b. 7.2%

c. 9.10%

d. 11.5%

Answers here:

Questions:

705.1. In a single-factor economy, each of the following portfolios (A, B, and C) is well-diversified:

You discover there is NOT an arbitrage strategy among these three portfolios. In this case, what should be the expected return of Portfolio (C)?

a. 13.3%

b. 16.3%

c. 18.5%

d. 21.0%

705.2. Assume a sock's returns are accurately characterized by the Fama-French three-factor model. The stock's own factor betas and the risk model's risk premiums are given below:

What is the firm's size/value style characteristics and what is the firm's required rate of return?

a. Small-cap, growth-oriented with a required return of 5.50%

b. Small-cap, value-oriented with a required return of 6.00%

c. Large-cap, growth-oriented with a required return of 3.50%

d. Large-cap, value-oriented with a required return of 8.00%

705.3. Consider below the multifactor (APT) model of security returns for a particular stock. In addition to factor betas and risk premiums, two of the factors experience "surprises." Specifically, while interest rates change as expected, actual inflation is +2.0% (compared to expected +1.0%) and actual GDP growth is +1.5% (compared to expected +0.5%):

What is the expected rate of return on the security?

a. 6.8%

b. 7.2%

c. 9.10%

d. 11.5%

Answers here: