Learning objectives: Describe the inputs, including factor betas, to a multifactor model. Calculate the expected return of an asset using a single-factor and a multifactor model.

Questions

704.1. Suppose that three factors have been identified for the U.S. economy:

a. 8.480%

b. 9.000%

c. 9.250%

d. 10.375%

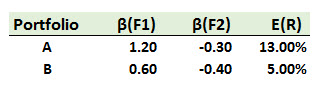

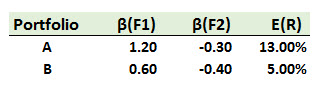

704.2. Suppose that there are two independent economic factors, F1 and F2 . The risk-free rate is 1.0%, and all stocks have independent firm-specific components with a standard deviation of 25%. The following are well-diversified portfolios; e.g., Portfolio (A) has a beta sensitivity to factor the first factor, β(F1), of 1.20 and an expected return of 13.0%:

Which is the correct return-beta relationship in this economy?

a. E[R(P)] = 1.0% - β(F1)*6.0% - β(F2)*4.0%

b. E[R(P)] = 1.0% - β(F1)*5.0% + β(F2)*2.0%

c. E[R(P)] = 1.0% + β(F1)*9.0% + β(F2)*3.0%

d. E[R(P)] = 1.0% + β(F1)*12.0% + β(F2)*8.0%

704.3. Your colleague Richard has designed the first draft of an explicit multifactor model for your review. You immediately make the following four observations about his model. According to Bodie, which of the following observations probably should raise a red flag; i.e., which observation by itself is the MOST LIKELY to indicate that Peter may have developed an inferior multifactor model?

a. One of the model's factor risk premium is negative

b. The model contains Fama-French type size and value factors which are obviously firm-specific but not macroeconomic

c. Few, if any, investors seek to hedge the model's systematic risk factors or realistically even care about the associated uncertainties

d. The model contains fewer than ten systematic factors in attempting to explain excess returns in a complex economy and these factors are correlated with major sources of uncertainty

Answers here:

Questions

704.1. Suppose that three factors have been identified for the U.S. economy:

- Expected inflation rate (IR) is +2.00%

- Expected 10-year Treasury yield (T-NOTE) is 2.40%

- Expected growth in productivity (PROD) is +3.00%

- Actual inflation rate (IR) is + 2.60%

- Actual 10-year Treasury yield (T-NOTE) is 3.00%

- Actual growth in productivity (PROD) +2.00%

a. 8.480%

b. 9.000%

c. 9.250%

d. 10.375%

704.2. Suppose that there are two independent economic factors, F1 and F2 . The risk-free rate is 1.0%, and all stocks have independent firm-specific components with a standard deviation of 25%. The following are well-diversified portfolios; e.g., Portfolio (A) has a beta sensitivity to factor the first factor, β(F1), of 1.20 and an expected return of 13.0%:

Which is the correct return-beta relationship in this economy?

a. E[R(P)] = 1.0% - β(F1)*6.0% - β(F2)*4.0%

b. E[R(P)] = 1.0% - β(F1)*5.0% + β(F2)*2.0%

c. E[R(P)] = 1.0% + β(F1)*9.0% + β(F2)*3.0%

d. E[R(P)] = 1.0% + β(F1)*12.0% + β(F2)*8.0%

704.3. Your colleague Richard has designed the first draft of an explicit multifactor model for your review. You immediately make the following four observations about his model. According to Bodie, which of the following observations probably should raise a red flag; i.e., which observation by itself is the MOST LIKELY to indicate that Peter may have developed an inferior multifactor model?

a. One of the model's factor risk premium is negative

b. The model contains Fama-French type size and value factors which are obviously firm-specific but not macroeconomic

c. Few, if any, investors seek to hedge the model's systematic risk factors or realistically even care about the associated uncertainties

d. The model contains fewer than ten systematic factors in attempting to explain excess returns in a complex economy and these factors are correlated with major sources of uncertainty

Answers here: