Shau_2207

Member

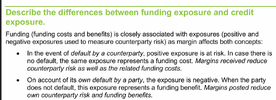

@David Harper CFA FRM ,

Can you please help me explain this?

As I understand the it should be default of the counterparty increase funding cost when margin is not posted the party with positive exposure has to fund the amount of loss. Similarly in the second sentence.

Can you please help me explain this?

As I understand the it should be default of the counterparty increase funding cost when margin is not posted the party with positive exposure has to fund the amount of loss. Similarly in the second sentence.