Didn't see a thread link for this q on the notes and couldn't find one so starting a thread on Q1 in question set for Bodie.

The answer for this in terms of expected return is 15%. The explanation is b/c "According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero by definition)" This makes no sense to me b/c in the previous q10 for a similarly worded query of "If T-bills currently offer a 6% yield, find the expected rate of return on this stock if the market views the stock as fairly priced" we do take into account the risk premiums.

I am probably a nuance here but why do we multiply by risk premiums to find expected return in 1 case but not in another?

Bodie EOC Question 11 (page 24):

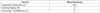

Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums.

The return on a particular stock is generated according to the following equation: r = 15% +1.0I + .5R + .75C + e

Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. Is the stock over- or underpriced? Explain.

Answer:

The APT required (i.e., equilibrium) rate of return on the stock based on rf and the factor betas is:

required E(r) = 6% + (1 x 6%) + (0.5 x 2%) + (0.75 x 4%) = 16%

According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero by definition). Because the actually expected return based on risk is less than the equilibrium return, we conclude that the stock is overpriced.

The answer for this in terms of expected return is 15%. The explanation is b/c "According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero by definition)" This makes no sense to me b/c in the previous q10 for a similarly worded query of "If T-bills currently offer a 6% yield, find the expected rate of return on this stock if the market views the stock as fairly priced" we do take into account the risk premiums.

I am probably a nuance here but why do we multiply by risk premiums to find expected return in 1 case but not in another?

Bodie EOC Question 11 (page 24):

Suppose that the market can be described by the following three sources of systematic risk with associated risk premiums.

The return on a particular stock is generated according to the following equation: r = 15% +1.0I + .5R + .75C + e

Find the equilibrium rate of return on this stock using the APT. The T-bill rate is 6%. Is the stock over- or underpriced? Explain.

Answer:

The APT required (i.e., equilibrium) rate of return on the stock based on rf and the factor betas is:

required E(r) = 6% + (1 x 6%) + (0.5 x 2%) + (0.75 x 4%) = 16%

According to the equation for the return on the stock, the actually expected return on the stock is 15% (because the expected surprises on all factors are zero by definition). Because the actually expected return based on risk is less than the equilibrium return, we conclude that the stock is overpriced.

Last edited by a moderator: