gargi.adhikari

Active Member

Hi,

This in reference to the Topic Valuation & Risk Models- Tuckman-Chapter 4-Dollar Value of zero and Hedging:-

Learning Spreadsheet: 4c.3 DV01_hedge

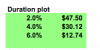

The Actual Value of the Zero Coupon Bond was Computed to be 30.12. I'm having trouble with the formula that has been used which is face*EXP(-(C5+1)*T)-face*EXP(-C5*T) , where C5= Yield which seems off to me.

With a Yield = 4%, Isnt the actual value derived simply as Face * Exp( - YT)=100* exp( -.04*30) = 30.12 ...?

Want to make sure am not missing a key concept here...

This in reference to the Topic Valuation & Risk Models- Tuckman-Chapter 4-Dollar Value of zero and Hedging:-

Learning Spreadsheet: 4c.3 DV01_hedge

The Actual Value of the Zero Coupon Bond was Computed to be 30.12. I'm having trouble with the formula that has been used which is face*EXP(-(C5+1)*T)-face*EXP(-C5*T) , where C5= Yield which seems off to me.

With a Yield = 4%, Isnt the actual value derived simply as Face * Exp( - YT)=100* exp( -.04*30) = 30.12 ...?

Want to make sure am not missing a key concept here...

Thank you for being so meticulous and helping us learn !

Thank you for being so meticulous and helping us learn !