gargi.adhikari

Active Member

Hi,

In reference to:

R31.P1.T4- Tuckman Chapter 2-Learning SpreadsheetT4.c Bundle : Sheet-Maturity vs Price

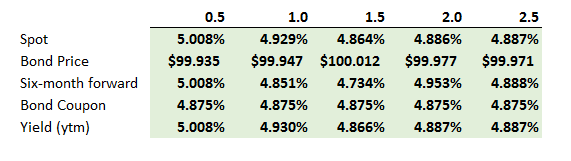

Please refer to the section circled in orange in the screenshot below. The Coupon is = 4.875% based on which the Cash Flows have been derived. But to calculate the discounted Prices for this bond, we have used the discount factors for another bond which has a different set of Coupons (highlighted in yellow) from which the discount factors have been deduced. How are we using discount factors for one bond for another bond...? I am probably missing a point or two here... Any insights on this would be much appreciated !

Any insights on this would be much appreciated !

In reference to:

R31.P1.T4- Tuckman Chapter 2-Learning SpreadsheetT4.c Bundle : Sheet-Maturity vs Price

Please refer to the section circled in orange in the screenshot below. The Coupon is = 4.875% based on which the Cash Flows have been derived. But to calculate the discounted Prices for this bond, we have used the discount factors for another bond which has a different set of Coupons (highlighted in yellow) from which the discount factors have been deduced. How are we using discount factors for one bond for another bond...? I am probably missing a point or two here...

Any insights on this would be much appreciated !

Any insights on this would be much appreciated !