Learning objectives: Distinguish the various sources of non-deposit liabilities at a bank. Describe and calculate the available funds gap. Discuss factors affecting the choice of non-deposit funding sources. Calculate overall cost of funds using both the historical average cost approach and the pooled funds approach.

Questions:

20.14.1. According to Rose and Hudgins, the factors affecting the choice of non-deposit funding sources include the following: the relative costs of each funding source; the risk of each funding source, including the dependability and volatility; the length of time for which funds will be needed; the size of the financial institution needing the funds; and regulations on the use of other sources of funds. In regard to the various sources of non-deposit funding, which of the following statements is TRUE?

a. The Fed Funds market is the least popular because its effective interest rate is higher than the alternatives

b. Repurchase agreements are more popular than Fed Funds because they are simpler, however, they incur greater credit risk

c. The advantages of the commercial paper (CP) market are the lack of credit risk and consistently high (i.e., low volatility) credit availability, however, volume tends to be low and relative cost is high

d. Advances from Federal Home Loan Banks (aka, FHLBanks) are highly popular among thrifts and small banks as a stable source of flexible (with respect to maturity) funding at below-market interest rates

20.14.2. Suppose a commercial bank situation today includes the following:

a. $37.5 million

b. $75.0 million

c. $150.0 million

d. $300.0 millin

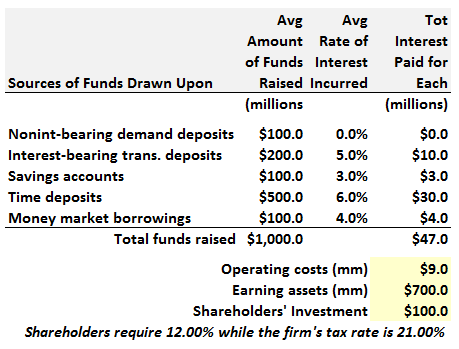

20.14.3. [Difficult] Suppose a bank is faced with the interest rates below for the sources of funds upon which it draws. The non-interest-bearing demand deposits have a rate of 0%, while the other sources have rates ranging from 3.0% to 6.0%. The total interest costs is $47.0 million:

Also displayed in the exhibit: The bank's operating costs (including salaries and overhead) are $9.0 million. The bank has $700.0 million in (interest) earning assets and stockholders' investment (aka, equity) is $100.0 million. Finally, we can assume that stockholders have a required after-tax return of 12.0%, while the firm's tax rate is 21.0%; therefore, stockholders' pretax required rate of return is 12.0%/(1 - 21.0%) = 15.19%. According to the historical average cost approach, the fully-loaded LOWEST rate of return over all fund-raising costs the bank can afford to earn on its assets is given by the bank's weighted average cost of capital (WACC).

Here is a key solving hint: WACC = break-even cost on borrowed funds (%) plus (+) before-tax cost of stockholders' investment (%); in percentage terms, the before-tax stockholder costs = stockholders' pretax required rate of return (%) × (stockholders' investment / earning assets). What is this bank's WACC?

a. 9.38%

b. 10.17%

c. 11.54%

d. 12.00%

Answers here:

Questions:

20.14.1. According to Rose and Hudgins, the factors affecting the choice of non-deposit funding sources include the following: the relative costs of each funding source; the risk of each funding source, including the dependability and volatility; the length of time for which funds will be needed; the size of the financial institution needing the funds; and regulations on the use of other sources of funds. In regard to the various sources of non-deposit funding, which of the following statements is TRUE?

a. The Fed Funds market is the least popular because its effective interest rate is higher than the alternatives

b. Repurchase agreements are more popular than Fed Funds because they are simpler, however, they incur greater credit risk

c. The advantages of the commercial paper (CP) market are the lack of credit risk and consistently high (i.e., low volatility) credit availability, however, volume tends to be low and relative cost is high

d. Advances from Federal Home Loan Banks (aka, FHLBanks) are highly popular among thrifts and small banks as a stable source of flexible (with respect to maturity) funding at below-market interest rates

20.14.2. Suppose a commercial bank situation today includes the following:

- New loan requests (that meet quality standards) of $250.00 million

- Plans to purchase $100.00 million in Treasuries in the coming week

- Anticipates $140.0 million in drawings on credit lines from its best corporate customers

- Deposits and other customer funds received today (aka, current deposit inflows) total $110.00 million

- Expected deposit inflows of $230.0 million in the coming week

a. $37.5 million

b. $75.0 million

c. $150.0 million

d. $300.0 millin

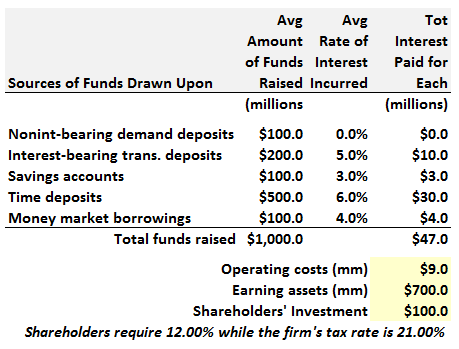

20.14.3. [Difficult] Suppose a bank is faced with the interest rates below for the sources of funds upon which it draws. The non-interest-bearing demand deposits have a rate of 0%, while the other sources have rates ranging from 3.0% to 6.0%. The total interest costs is $47.0 million:

Also displayed in the exhibit: The bank's operating costs (including salaries and overhead) are $9.0 million. The bank has $700.0 million in (interest) earning assets and stockholders' investment (aka, equity) is $100.0 million. Finally, we can assume that stockholders have a required after-tax return of 12.0%, while the firm's tax rate is 21.0%; therefore, stockholders' pretax required rate of return is 12.0%/(1 - 21.0%) = 15.19%. According to the historical average cost approach, the fully-loaded LOWEST rate of return over all fund-raising costs the bank can afford to earn on its assets is given by the bank's weighted average cost of capital (WACC).

Here is a key solving hint: WACC = break-even cost on borrowed funds (%) plus (+) before-tax cost of stockholders' investment (%); in percentage terms, the before-tax stockholder costs = stockholders' pretax required rate of return (%) × (stockholders' investment / earning assets). What is this bank's WACC?

a. 9.38%

b. 10.17%

c. 11.54%

d. 12.00%

Answers here:

Last edited by a moderator: