AIMs: Describe wrong-way risk and contrast it with right-way risk. Identify examples of wrong-way risk and examples of right-way risk.

Questions:

419.1. From the perspective of Acme Financial Institution, each of the following positions is likely to incur wrong-way risk EXCEPT which position is likely to benefit from right-way risk?

a. Acme takes a long position in (buys) an out-of-the-money put option on a back's stock where another bank, who is short, is the counterparty

b. Acme is the floating-rate payer (and fixed-rate receiver) in a vanilla interest rate swap with a bank, while Acme's economist has demonstrated that low rates are indicative of a recession

c. Acme takes a long position in an oil commodity swap with an oil producer, where Acme pays based on a fixed oil price and receives cash flows based on the spot price of oil

d. Acme buys credit protection in a credit default swap (CDS) contract where there exists a strong positive relationship between the credit quality of the reference entity and the CDS protection seller

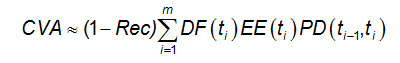

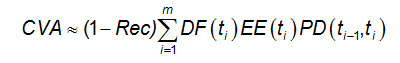

419.2. Before the introduction of wrong-way risk, Gregory provides the following "standard equation" for the credit value adjustment (CVA):

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

In the presence of wrong-way risk, which adjustment to this CVA expression is preferred?

a. The (1-Rec) is removed in order to reflect the most conservative possible assumption about recovery

b. The DF(t) term is increased to adjust the risk-free discount factor that accounts for correlation

c. The EE(t) term is replaced with an exposure conditional upon default of the counterparty

d. None, the CVA expression is unusable in the presence of wrong-way risk

419.3. Assume Acme Financial Institution enters a position in an over-the-counter (OTC) European stock option with a counterparty. Per Gregory's modified Black-Scholes formula with counterparty risk, the variable (h) signifies the hazard rate of the counterparty and rho (ρ) signifies the correlation between the underlying's stock price and default time of the counterparty. About the relationship between this option position and wrong-way risk, which of the following is true?

a. Because both long and short option positions incur counterparty risk in approximately the same measure, put-call parity can be applied as usual to infer option prices

b. Under positive correlation between stock price and default time, Acme's long position in call option will incur wrong-way risk

c. Under negative correlation between stock price and default time, Acme's long position in a put option will incur wrong-way risk

d. Under positive correlation between stock price and default time, Acme's long position in a deeply out-of-the-money (OTM) put incurs more wrong-way risk than an at-the-money (ATM) put

Answers here:

Questions:

419.1. From the perspective of Acme Financial Institution, each of the following positions is likely to incur wrong-way risk EXCEPT which position is likely to benefit from right-way risk?

a. Acme takes a long position in (buys) an out-of-the-money put option on a back's stock where another bank, who is short, is the counterparty

b. Acme is the floating-rate payer (and fixed-rate receiver) in a vanilla interest rate swap with a bank, while Acme's economist has demonstrated that low rates are indicative of a recession

c. Acme takes a long position in an oil commodity swap with an oil producer, where Acme pays based on a fixed oil price and receives cash flows based on the spot price of oil

d. Acme buys credit protection in a credit default swap (CDS) contract where there exists a strong positive relationship between the credit quality of the reference entity and the CDS protection seller

419.2. Before the introduction of wrong-way risk, Gregory provides the following "standard equation" for the credit value adjustment (CVA):

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

In the presence of wrong-way risk, which adjustment to this CVA expression is preferred?

a. The (1-Rec) is removed in order to reflect the most conservative possible assumption about recovery

b. The DF(t) term is increased to adjust the risk-free discount factor that accounts for correlation

c. The EE(t) term is replaced with an exposure conditional upon default of the counterparty

d. None, the CVA expression is unusable in the presence of wrong-way risk

419.3. Assume Acme Financial Institution enters a position in an over-the-counter (OTC) European stock option with a counterparty. Per Gregory's modified Black-Scholes formula with counterparty risk, the variable (h) signifies the hazard rate of the counterparty and rho (ρ) signifies the correlation between the underlying's stock price and default time of the counterparty. About the relationship between this option position and wrong-way risk, which of the following is true?

a. Because both long and short option positions incur counterparty risk in approximately the same measure, put-call parity can be applied as usual to infer option prices

b. Under positive correlation between stock price and default time, Acme's long position in call option will incur wrong-way risk

c. Under negative correlation between stock price and default time, Acme's long position in a put option will incur wrong-way risk

d. Under positive correlation between stock price and default time, Acme's long position in a deeply out-of-the-money (OTM) put incurs more wrong-way risk than an at-the-money (ATM) put

Answers here: