AIMs: Explain the motivation for and the challenges of pricing counterparty risk. Describe credit value adjustment (CVA). Calculate CVA and the CVA spread with no wrong-way risk, netting, or collateralization.

Questions:

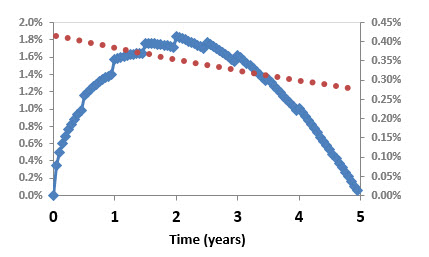

417.1. The following graphs two (of the four) components which directly inform the credit value adjustment (CVA) of a five-year interest rate swap:

The calculations do assume a constant hazard rate (default intensity). Consider the following descriptions of the two components plotted above, which inform the swap's CVA calculation:

I. The solid blue line is potential future exposure (PFE)

II. The dotted red line is the marginal (aka, unconditional) default probability

Which of the above statements is (are) likely true?

a. Neither

b. I. only

c. II. only

d. Both

417.2. CityBank is going to enter into a swap contract with FinCorp. From CityBank's perspective, the EPE (expected positive exposure) of the trade is 6.00% and the expected negative exposure (ENE) is 4.20%. CityBank's credit spread is 110 basis points per annum, while FinCorp's credit spread is 250 bps. From CityBank's perspective, the maximum PFE is 18.0%. Which is nearest to estimate of the BCVA (bilateral credit value adjustment)?

a. 5.49 bps

b. 10.38 bps

c. 23.00 bps

d. 42.58 bps

417.3. CityBank enters a long position in an over-the-counter (OTC), out-of-the-money (OTM) put option with a five year term. The strike price of the put is $50.00 while the current asset price is $70.00 with asset volatility of 30.0%. The risk-free rate is 4.0% with continuous compounding. N(d1) = 0.870 and N(d2) = 0.680. CityBank assumes the present-valued expected exposure (EE) to the counterparty equals the option's present value. The probability of default by the counterparty is 8.0% with loss given default (LGD) of 75.0%. Which is nearest to the credit risk-adjusted value of the long option position, where credit risk-adjusted refers to incorporating an approximate credit valuation adjustment (CVA)?

a. $3.76

b. $4.25

c. $6.99

d. $8.51

Answers here:

Questions:

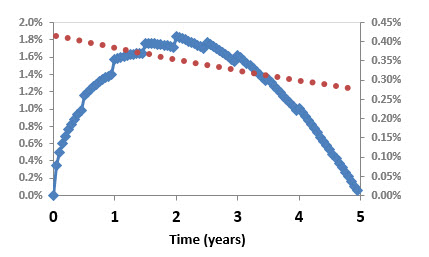

417.1. The following graphs two (of the four) components which directly inform the credit value adjustment (CVA) of a five-year interest rate swap:

The calculations do assume a constant hazard rate (default intensity). Consider the following descriptions of the two components plotted above, which inform the swap's CVA calculation:

I. The solid blue line is potential future exposure (PFE)

II. The dotted red line is the marginal (aka, unconditional) default probability

Which of the above statements is (are) likely true?

a. Neither

b. I. only

c. II. only

d. Both

417.2. CityBank is going to enter into a swap contract with FinCorp. From CityBank's perspective, the EPE (expected positive exposure) of the trade is 6.00% and the expected negative exposure (ENE) is 4.20%. CityBank's credit spread is 110 basis points per annum, while FinCorp's credit spread is 250 bps. From CityBank's perspective, the maximum PFE is 18.0%. Which is nearest to estimate of the BCVA (bilateral credit value adjustment)?

a. 5.49 bps

b. 10.38 bps

c. 23.00 bps

d. 42.58 bps

417.3. CityBank enters a long position in an over-the-counter (OTC), out-of-the-money (OTM) put option with a five year term. The strike price of the put is $50.00 while the current asset price is $70.00 with asset volatility of 30.0%. The risk-free rate is 4.0% with continuous compounding. N(d1) = 0.870 and N(d2) = 0.680. CityBank assumes the present-valued expected exposure (EE) to the counterparty equals the option's present value. The probability of default by the counterparty is 8.0% with loss given default (LGD) of 75.0%. Which is nearest to the credit risk-adjusted value of the long option position, where credit risk-adjusted refers to incorporating an approximate credit valuation adjustment (CVA)?

a. $3.76

b. $4.25

c. $6.99

d. $8.51

Answers here:

Last edited by a moderator: