AIMs: Explain the features of a collateralization agreement. Differentiate between a two-way and one-way CSA agreement and describe how collateral parameters can be linked to credit quality. Explain how market risk, operational risk, and liquidity risk (including funding liquidity risk) can arise through collateralization

Questions:

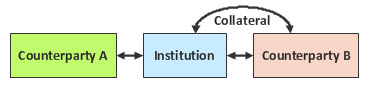

410.1. Consider a financial Institution that enters a derivatives trade with Counterparty A and hedges this transaction by trading a derivative with Counterparty B. Under a CSA agreement, Counterparty B posts collateral:

According to Gregory, each of the following is true EXCEPT which is not?

a. If the CSA allows for an optional substitution then Counterparty B can, without requiring consent, post an alternative amount of eligible (haircut applied) collateral; and, upon receipt, the original collateral will be released by the Institution

b. By pledging collateral, in all cases Counterparty B immediately passes legal title to, and economic ownership of, the collateral asset to the Institution, exactly "as if the collateral was sold."

c. If a re-hypothetication right is attached, then the Institution can post the collateral to Counterparty A; i.e., the Institution can "re-use" the collateral

d. In general, re-hypothecation decreases funding liquidity risk but increases counterparty risk and systematic risk (by increasing system interconnectedness via collateral chains)

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

While certain types of rehypothecation can be beneficial to market functioning, if collateral collected to protect against the risk of counterparty default has been rehypothecated, then it may not be readily available in the event of a default. This, in turn, may increase system interconnectedness and procyclicality, and could amplify market

410.2. In detailing the terms of a collateralization agreement, Barbara seeks to mitigate her firm's exposure to a counterparty default, as much as possible. For example, if she could afford the increased operational workload, she would prefer to perfectly mitigate the exposure. Each of these adjustments will tend to successfully increase the degree of mitigation EXCEPT for which will not?

a. Increase the independent amount

b. Increase the threshold

c. Decrease the minimum transfer amount

d. Increase the margin call frequency (e.g., from weekly to daily)

410.3. A financial institution (FI) enters a derivatives trade with a Counterparty (CP) under a two-way CSA agreement. The CSA agreement contains identical parameters for both parties, including a daily valuation, a mutual threshold of $100,000 and a mutual minimum transfer amount (MTA) of $40,000. Today, at inception T(0), the exposure (E) is zero to both parties. However, over the next two days, the financial institution (FI) experiences a gain on the trade such that it incurs exposure:

a. On T(1) the counterparty posts collateral (L) with market value of $18,750

b. On T(1) the counterparty posts collateral (L) with market value of $143,750

c. On T(2) the counterparty posts collateral (L) with market value of $50,000

d. On T(2) the counterparty posts collateral (L) with market value of $62,500

Answers here:

Questions:

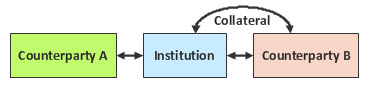

410.1. Consider a financial Institution that enters a derivatives trade with Counterparty A and hedges this transaction by trading a derivative with Counterparty B. Under a CSA agreement, Counterparty B posts collateral:

According to Gregory, each of the following is true EXCEPT which is not?

a. If the CSA allows for an optional substitution then Counterparty B can, without requiring consent, post an alternative amount of eligible (haircut applied) collateral; and, upon receipt, the original collateral will be released by the Institution

b. By pledging collateral, in all cases Counterparty B immediately passes legal title to, and economic ownership of, the collateral asset to the Institution, exactly "as if the collateral was sold."

c. If a re-hypothetication right is attached, then the Institution can post the collateral to Counterparty A; i.e., the Institution can "re-use" the collateral

d. In general, re-hypothecation decreases funding liquidity risk but increases counterparty risk and systematic risk (by increasing system interconnectedness via collateral chains)

(Source: Jon Gregory, Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets, 2nd Edition (West Sussex, UK: John Wiley & Sons, 2012))

While certain types of rehypothecation can be beneficial to market functioning, if collateral collected to protect against the risk of counterparty default has been rehypothecated, then it may not be readily available in the event of a default. This, in turn, may increase system interconnectedness and procyclicality, and could amplify market

410.2. In detailing the terms of a collateralization agreement, Barbara seeks to mitigate her firm's exposure to a counterparty default, as much as possible. For example, if she could afford the increased operational workload, she would prefer to perfectly mitigate the exposure. Each of these adjustments will tend to successfully increase the degree of mitigation EXCEPT for which will not?

a. Increase the independent amount

b. Increase the threshold

c. Decrease the minimum transfer amount

d. Increase the margin call frequency (e.g., from weekly to daily)

410.3. A financial institution (FI) enters a derivatives trade with a Counterparty (CP) under a two-way CSA agreement. The CSA agreement contains identical parameters for both parties, including a daily valuation, a mutual threshold of $100,000 and a mutual minimum transfer amount (MTA) of $40,000. Today, at inception T(0), the exposure (E) is zero to both parties. However, over the next two days, the financial institution (FI) experiences a gain on the trade such that it incurs exposure:

- Tomorrow, T(1), FI's exposure to CP increases to $115,000

- On the next day, T(2), the trade gains a further $35,000 such that FI's exposure to CP increases to $150,000

a. On T(1) the counterparty posts collateral (L) with market value of $18,750

b. On T(1) the counterparty posts collateral (L) with market value of $143,750

c. On T(2) the counterparty posts collateral (L) with market value of $50,000

d. On T(2) the counterparty posts collateral (L) with market value of $62,500

Answers here:

Last edited by a moderator: