AIMs: Describe a simulation approach to calculating credit losses for different tranches in a securitization of a portfolio of loans. Explain how the probability of default and default correlation among the underlying assets of a securitization affects the value, losses and Credit VaR of equity, junior, and senior tranches.

Questions:

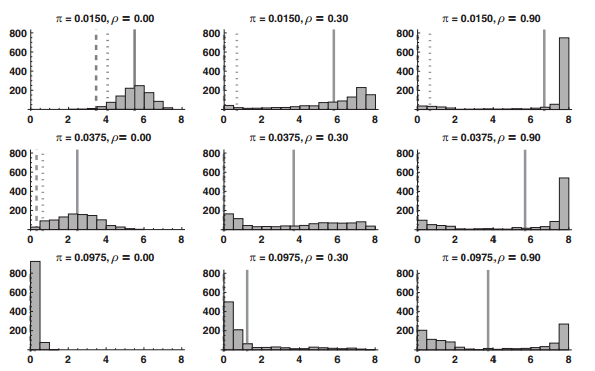

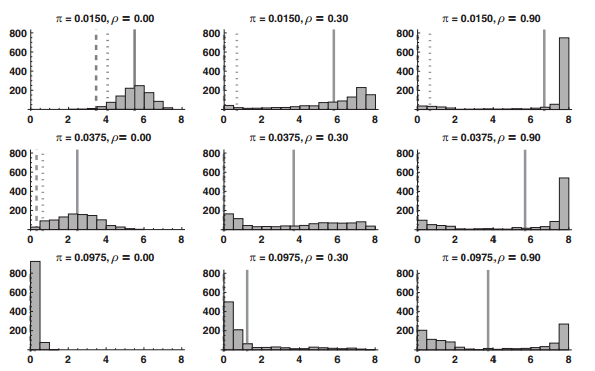

314.1. Equity Tranche: Malz employs a simulation approach in order to generalize about a three-tiered securitization. Below is the graphical summary of the distribution of simulated equity tranche values (Figure 9.2). Values are in millions of dollars, with the cash flows discounted at an internal rate of return (IRR) of 25%:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Each histogram is labeled by its default probability and correlation assumption. The solid grid line marks the mean value over the 1,000 simulations. The dashed and dotted grid lines mark the 0.01 and 0.05 quantile values. With respect to the credit VaR of the equity tranche, Malz writes, "we measure the credit VaR at a confidence level of 99 (or 95) percent as the difference between the 10th (or 50th) lowest sorted simulation value and the par value of $5,000,000. The latter value, as noted, is close to the mean present value of the cash flows with default (pi) = 2.25 percent and correlation (ρ) =0.30. The 99-percent credit VaR can then be read graphically as the horizontal distance between the dashed and solid grid lines.

With respect to the equity tranche, each of the following is true EXCEPT which is false?

a. For a given correlation, an increase in the default rate implies a lower (expected) equity tranche value

b. For a given default rate, an increase in correlation implies an increase in (expected) equity tranche value

c. For a given default rate, an increase in correlation implies a decrease in equity Credit VaR; but for a given correlation, a higher default rate implies an increase in equity Credit VaR

d. At low correlations, the equity value is substantially positively convex in default rates

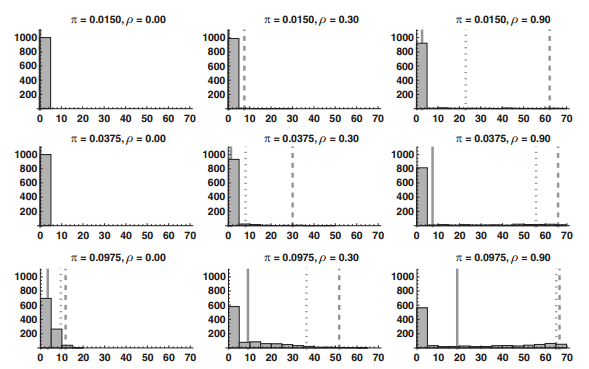

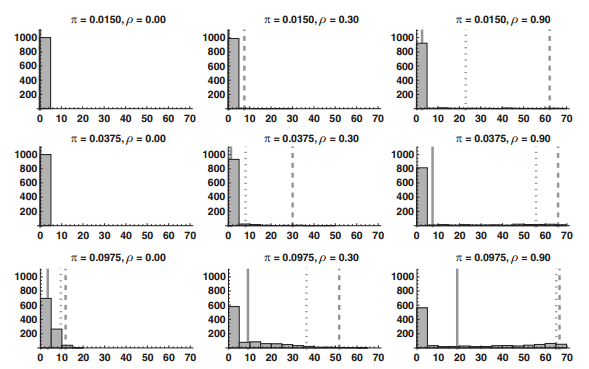

314.2. Senior Bond Tranche: The following is the graphical summary of the distribution of simulated senior bond tranche losses (Malz Figure 9.4). Please notice, in contrast to the equity tranche (above) which displays VALUES, the bond tranches are graph according to their LOSSES:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

According to Malz, "For the bonds, we measure the VaR as the difference between the expected loss and the 10th (or 50th) highest loss in the simulations." With respect to the senior bond tranche, each of the following is true EXCEPT which is false?

a. For a given positive default correlation, an increase in the default rate generally implies an increase in (expected) senior bond losses

b. For a given default rate, an increase in the correlation rate implies an increase in (expected) senior bond losses

c. At a very high correlation of 0.90, the senior bond 99% credit VaR is significant (on the order of one half the par value) but not highly sensitive to the default rate

d. The low-default, high-correlation simulation (default rate=0.0150, rho=0.90) produces a lower senior bond 99% credit VaR than the high-default, low-correlation (default rate=0.0975, rho=0)

314.3. In Malz's simulation, the mezzanine tranche has a width of only 10%. It is typical for the mezzanine tranche to be thinner than the senior bond. In regard to the mezzanine tranche, each of the following is true EXCEPT which is false?

a. At low default rates, an increase in correlation increases losses on the mezzanine bond (behaves like a senior bond)

b. At high default rates, an increase in correlation decreases losses on the mezzanine bond (behaves like equity)

c. The mezzanine tranche has negative convexity in default rates for low default rates (behaves like a senior bond), but is positively convex for high default rates (behaves like equity)

d. At low correlations, for example rho = zero, the mezzanine tranche is essentially insensitive to changes in the default rate (behaves like a senior bond)

Answers:

Questions:

314.1. Equity Tranche: Malz employs a simulation approach in order to generalize about a three-tiered securitization. Below is the graphical summary of the distribution of simulated equity tranche values (Figure 9.2). Values are in millions of dollars, with the cash flows discounted at an internal rate of return (IRR) of 25%:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

Each histogram is labeled by its default probability and correlation assumption. The solid grid line marks the mean value over the 1,000 simulations. The dashed and dotted grid lines mark the 0.01 and 0.05 quantile values. With respect to the credit VaR of the equity tranche, Malz writes, "we measure the credit VaR at a confidence level of 99 (or 95) percent as the difference between the 10th (or 50th) lowest sorted simulation value and the par value of $5,000,000. The latter value, as noted, is close to the mean present value of the cash flows with default (pi) = 2.25 percent and correlation (ρ) =0.30. The 99-percent credit VaR can then be read graphically as the horizontal distance between the dashed and solid grid lines.

With respect to the equity tranche, each of the following is true EXCEPT which is false?

a. For a given correlation, an increase in the default rate implies a lower (expected) equity tranche value

b. For a given default rate, an increase in correlation implies an increase in (expected) equity tranche value

c. For a given default rate, an increase in correlation implies a decrease in equity Credit VaR; but for a given correlation, a higher default rate implies an increase in equity Credit VaR

d. At low correlations, the equity value is substantially positively convex in default rates

314.2. Senior Bond Tranche: The following is the graphical summary of the distribution of simulated senior bond tranche losses (Malz Figure 9.4). Please notice, in contrast to the equity tranche (above) which displays VALUES, the bond tranches are graph according to their LOSSES:

(Source: Allan Malz, Financial Risk Management: Models, History, and Institutions (Hoboken, NJ: John Wiley & Sons, 2011))

According to Malz, "For the bonds, we measure the VaR as the difference between the expected loss and the 10th (or 50th) highest loss in the simulations." With respect to the senior bond tranche, each of the following is true EXCEPT which is false?

a. For a given positive default correlation, an increase in the default rate generally implies an increase in (expected) senior bond losses

b. For a given default rate, an increase in the correlation rate implies an increase in (expected) senior bond losses

c. At a very high correlation of 0.90, the senior bond 99% credit VaR is significant (on the order of one half the par value) but not highly sensitive to the default rate

d. The low-default, high-correlation simulation (default rate=0.0150, rho=0.90) produces a lower senior bond 99% credit VaR than the high-default, low-correlation (default rate=0.0975, rho=0)

314.3. In Malz's simulation, the mezzanine tranche has a width of only 10%. It is typical for the mezzanine tranche to be thinner than the senior bond. In regard to the mezzanine tranche, each of the following is true EXCEPT which is false?

a. At low default rates, an increase in correlation increases losses on the mezzanine bond (behaves like a senior bond)

b. At high default rates, an increase in correlation decreases losses on the mezzanine bond (behaves like equity)

c. The mezzanine tranche has negative convexity in default rates for low default rates (behaves like a senior bond), but is positively convex for high default rates (behaves like equity)

d. At low correlations, for example rho = zero, the mezzanine tranche is essentially insensitive to changes in the default rate (behaves like a senior bond)

Answers: