Harshita Phalor

New Member

GARP- Book 2- Valuation- Chapter 1- Question 13

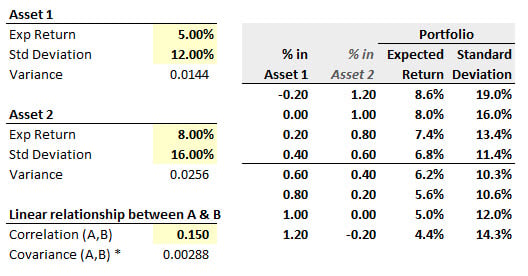

- For the two investments considered in Table 1.2 and Figure 1.2, what are the risk-return combinations if the correlation is 0.15 instead of 0.25?

Attachments

Last edited: