Learning outcome: Describe a dollar roll transaction and how to value a dollar roll.

Questions:

510.1. Consider an investor who wants to finance the purchase of a mortgage pool over a one month period. One alternative is to sell an MBS repo, in which case the investor could sell the pool today while simultaneously agreeing to repurchase it after a month. This trade has the same economics as a secured loan: the investor effectively borrows cash today by posting the pool as collateral, and, upon paying back the loan with interest after a month, retrieves the collateral. An alternative is the "dollar roll." In the dollar roll, the buyer of the roll sells a TBA for one settlement month (the "earlier month") and buys the same TBA for the following settlement month (the "later month").

For example, the investor who just purchased a 30-year 4% FNMA pool might sell the FNMA 30-year 4% January TBA and buy the FNMA 30-year 4% February TBA. Delivering the pool just purchased through the sale of the January TBA, which raises cash, and purchasing a pool through the February TBA, which returns cash, is very close to the economics of a secured loan.

But there are two important differences between dollar roll and repo financing:

I. The buyer of the roll may not get back in the later month the same pool delivered in the earlier month. The buyer of the roll delivers a particular pool, for example, in January but will have to accept whatever eligible pool is delivered in the next February. By contrast, an MBS repo seller is always returned the same pool that was originally posted as collateral.

II. The buyer of the roll does not receive any interest or principal payments from the pool over the roll. For example, the buyer of the Jan/Feb roll, who delivers the pool in January, does not receive the January payments of interest and principal. By contrast, a repo seller receives any payments of interest and principal over the life of the repo. While the prices of TBA contracts reflect the timing of payments, so that the buyer of a roll does not, in any sense, lose a month of payments relative to a repo seller, the risks of the two transactions are different. The buyer of a roll does not have any exposure to prepayments over the month being higher or lower than what had been implied by TBA prices while the repo seller does.

Which of these two differences is (are) correct?

a. Neither are correct

b. I. is true but II. is incorrect

c. I. is incorrect but II. is true

d. Both are correct

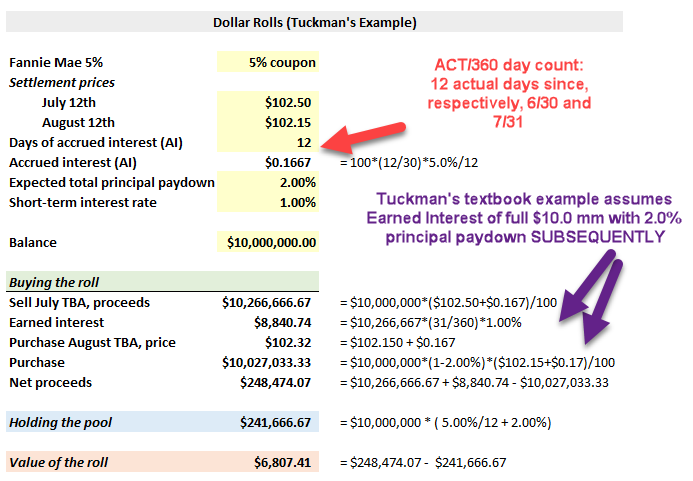

510.2. Consider the scenario (a variation on Tuckman's example) illustrated below. Suppose that the TBA prices of the Fannie Mae 6% for July 9 and August 9 settlements are $103.00 and $102.60, respectively. The accrued interest to be added to each of these prices is 9 actual/360 days of a month's worth of a 6.0% coupon, i.e., 100 × (9/30) × 6.0%/12 or $0.150. Let the expected total principal paydown, that is, scheduled principal plus prepayments, be 2.0% of outstanding balance and let the appropriate short-term rate be 1.0%.

If an investor rolls a balance of $10.0 million, proceeds from selling the July TBA are $10.0 million × (103.00 + 0.150)/100 or $10,315,000.00. Investing these proceeds to August 9 at 1.0% earns interest of $10,315,000.00 × (31/360) × 1.0% or $8,882.36. Then, purchasing the August TBA, which has experienced a 2.0% principal paydown, costs $10.0 million × (1 - 2.0%) × (102.60 + 0.150)/100 or $10,069,500.00. The net proceeds from the roll, therefore, are $10,315,000.00 + $8,882.36 - $10,069,500.00 or $254.382.36. If the investor does not roll, the net proceeds are the coupon plus principal paydown: $10,000,000.00 × (6.0%/12 + 2.0%) or $250,000.00.

(Tuckman's example: Bruce Tuckman, Angel Serrat, Fixed Income Securities: Tools for Today’s Markets, 3rd Edition (New York: Wiley, 2011))

Given this scenario, which of the following is true?

a. The roll trades above carry (i.e., the value of the roll is positive) and this might be rationally explained by delivery options of TBAs

b. The roll trades above carry (i.e., the value of the roll is positive) and this might be rationally explained by the relatively low short-term interest rate

c. The roll trades below carry (i.e., the value of the roll is negative) and this might be rationally explained by delivery options of TBAs

d. The roll trades at breakeven (i.e., the value of the roll is zero) and this is expected in efficient markets

510.3. Which of the following is most likely to exhibit a dollar value of an 01 (DV01) that is negative?

a. Principal-only (PO) at high yields

b. Interest-only (IO) strip at low yields

c. Interest only (IO) strip at high yields

d. Planned amortization class (PAC) bond at low yields

Answers here:

Questions:

510.1. Consider an investor who wants to finance the purchase of a mortgage pool over a one month period. One alternative is to sell an MBS repo, in which case the investor could sell the pool today while simultaneously agreeing to repurchase it after a month. This trade has the same economics as a secured loan: the investor effectively borrows cash today by posting the pool as collateral, and, upon paying back the loan with interest after a month, retrieves the collateral. An alternative is the "dollar roll." In the dollar roll, the buyer of the roll sells a TBA for one settlement month (the "earlier month") and buys the same TBA for the following settlement month (the "later month").

For example, the investor who just purchased a 30-year 4% FNMA pool might sell the FNMA 30-year 4% January TBA and buy the FNMA 30-year 4% February TBA. Delivering the pool just purchased through the sale of the January TBA, which raises cash, and purchasing a pool through the February TBA, which returns cash, is very close to the economics of a secured loan.

But there are two important differences between dollar roll and repo financing:

I. The buyer of the roll may not get back in the later month the same pool delivered in the earlier month. The buyer of the roll delivers a particular pool, for example, in January but will have to accept whatever eligible pool is delivered in the next February. By contrast, an MBS repo seller is always returned the same pool that was originally posted as collateral.

II. The buyer of the roll does not receive any interest or principal payments from the pool over the roll. For example, the buyer of the Jan/Feb roll, who delivers the pool in January, does not receive the January payments of interest and principal. By contrast, a repo seller receives any payments of interest and principal over the life of the repo. While the prices of TBA contracts reflect the timing of payments, so that the buyer of a roll does not, in any sense, lose a month of payments relative to a repo seller, the risks of the two transactions are different. The buyer of a roll does not have any exposure to prepayments over the month being higher or lower than what had been implied by TBA prices while the repo seller does.

Which of these two differences is (are) correct?

a. Neither are correct

b. I. is true but II. is incorrect

c. I. is incorrect but II. is true

d. Both are correct

510.2. Consider the scenario (a variation on Tuckman's example) illustrated below. Suppose that the TBA prices of the Fannie Mae 6% for July 9 and August 9 settlements are $103.00 and $102.60, respectively. The accrued interest to be added to each of these prices is 9 actual/360 days of a month's worth of a 6.0% coupon, i.e., 100 × (9/30) × 6.0%/12 or $0.150. Let the expected total principal paydown, that is, scheduled principal plus prepayments, be 2.0% of outstanding balance and let the appropriate short-term rate be 1.0%.

If an investor rolls a balance of $10.0 million, proceeds from selling the July TBA are $10.0 million × (103.00 + 0.150)/100 or $10,315,000.00. Investing these proceeds to August 9 at 1.0% earns interest of $10,315,000.00 × (31/360) × 1.0% or $8,882.36. Then, purchasing the August TBA, which has experienced a 2.0% principal paydown, costs $10.0 million × (1 - 2.0%) × (102.60 + 0.150)/100 or $10,069,500.00. The net proceeds from the roll, therefore, are $10,315,000.00 + $8,882.36 - $10,069,500.00 or $254.382.36. If the investor does not roll, the net proceeds are the coupon plus principal paydown: $10,000,000.00 × (6.0%/12 + 2.0%) or $250,000.00.

(Tuckman's example: Bruce Tuckman, Angel Serrat, Fixed Income Securities: Tools for Today’s Markets, 3rd Edition (New York: Wiley, 2011))

Given this scenario, which of the following is true?

a. The roll trades above carry (i.e., the value of the roll is positive) and this might be rationally explained by delivery options of TBAs

b. The roll trades above carry (i.e., the value of the roll is positive) and this might be rationally explained by the relatively low short-term interest rate

c. The roll trades below carry (i.e., the value of the roll is negative) and this might be rationally explained by delivery options of TBAs

d. The roll trades at breakeven (i.e., the value of the roll is zero) and this is expected in efficient markets

510.3. Which of the following is most likely to exhibit a dollar value of an 01 (DV01) that is negative?

a. Principal-only (PO) at high yields

b. Interest-only (IO) strip at low yields

c. Interest only (IO) strip at high yields

d. Planned amortization class (PAC) bond at low yields

Answers here:

Last edited:

!

!