Hesham_87

Member

Dear David,

while studying Miller ch2, I just wanna ask several questions:

based on definition of Joint Probability “The joint probability distribution of two discrete random variables, say X and Y, is the probability that the random variables simultaneously take on certain values, say x and y. The probabilities of all possible (x, y) combinations sum to 1. The joint probability distribution can be written as the function Pr(X = x, Y = y).” — Stock & Watson"

1- is it correct to consider that all joint probabilities are independent events?

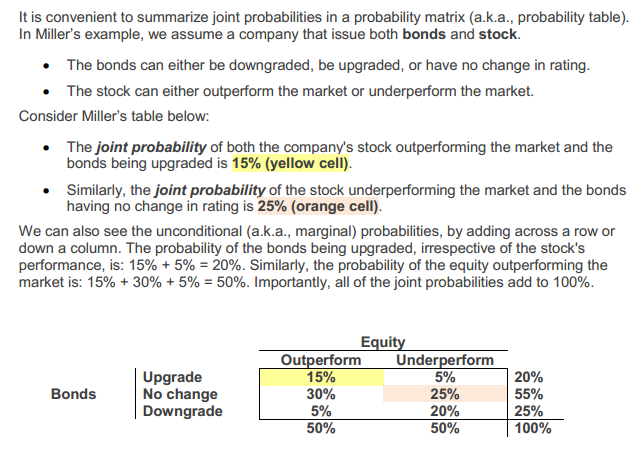

2- Page number 11 in Miller chapter 2 study note, the example of bonds and equity, it is understood that the probability of upgrading bond AND probability of outperform the stock is 15%, my question why did we add the following events ( probability of upgrading bonds, probability of outperforming stock AND probability of under performing stock) to get 20%, i mean it does not make sense a stock to outperform and under perform @ the same time, right?

while studying Miller ch2, I just wanna ask several questions:

based on definition of Joint Probability “The joint probability distribution of two discrete random variables, say X and Y, is the probability that the random variables simultaneously take on certain values, say x and y. The probabilities of all possible (x, y) combinations sum to 1. The joint probability distribution can be written as the function Pr(X = x, Y = y).” — Stock & Watson"

1- is it correct to consider that all joint probabilities are independent events?

2- Page number 11 in Miller chapter 2 study note, the example of bonds and equity, it is understood that the probability of upgrading bond AND probability of outperform the stock is 15%, my question why did we add the following events ( probability of upgrading bonds, probability of outperforming stock AND probability of under performing stock) to get 20%, i mean it does not make sense a stock to outperform and under perform @ the same time, right?