Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

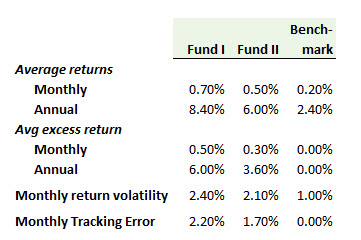

411.1. Gregory is analyzing the historical performance of two commodity funds (Fund I and Fund II) that each track the same index benchmark. He collated the following data below:

Please note that "excess return" is also known as "active return." Gregory wants to compare the two funds based on their annualized information ratio (IR). On this basis, which fund performs better?

a. Fund I because its annualized IR = 0.43

b. Fund I because its annualized IR = 0.66

c. Fund II because its annualized IR = 0.15

d. Fund II because its annualized IR = 0.54

411.2. A portfolio's realized Jensen's alpha is zero, happening to match its expected alpha. If the market's excess return (a.k.a., equity risk premium) was 5.0% while the portfolio's volatility was 12.0%, what is the portfolio's Treynor ratio?

a. 0.050

b. 0.120

c. 0.600

d. Not enough information (need the portfolio's beta or correlation to market)

411.3. Each of the following is true about the traditional risk-adjusted performance measures (i.e., Treynor, Sharpe, Jensen's alpha, information ratio and Sortino) EXCEPT which statement is false?

a. Unlike the Treynor and Jensen measures, the Sharpe ratio is not subject to Roll's criticism

b. While Jensen's alpha is useful for ranking portfolios with the same beta, the Sharpe ratio is better for ranking portfolios with different levels of risk

c. If a portfolio's excess returns are regressed against its benchmark's excess returns, and the regression intercept is assumed to be the portfolio's alpha, then the correct denominator for its information ratio is the residual risk

d. If the minimum acceptable return (MAR) is set to equal the risk-free rate, then the Sortino ratio is equal to the Sharpe ratio

Answers here:

Questions:

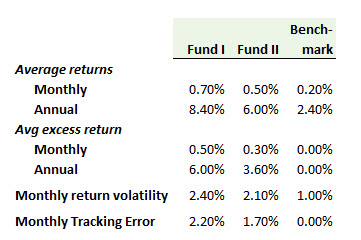

411.1. Gregory is analyzing the historical performance of two commodity funds (Fund I and Fund II) that each track the same index benchmark. He collated the following data below:

Please note that "excess return" is also known as "active return." Gregory wants to compare the two funds based on their annualized information ratio (IR). On this basis, which fund performs better?

a. Fund I because its annualized IR = 0.43

b. Fund I because its annualized IR = 0.66

c. Fund II because its annualized IR = 0.15

d. Fund II because its annualized IR = 0.54

411.2. A portfolio's realized Jensen's alpha is zero, happening to match its expected alpha. If the market's excess return (a.k.a., equity risk premium) was 5.0% while the portfolio's volatility was 12.0%, what is the portfolio's Treynor ratio?

a. 0.050

b. 0.120

c. 0.600

d. Not enough information (need the portfolio's beta or correlation to market)

411.3. Each of the following is true about the traditional risk-adjusted performance measures (i.e., Treynor, Sharpe, Jensen's alpha, information ratio and Sortino) EXCEPT which statement is false?

a. Unlike the Treynor and Jensen measures, the Sharpe ratio is not subject to Roll's criticism

b. While Jensen's alpha is useful for ranking portfolios with the same beta, the Sharpe ratio is better for ranking portfolios with different levels of risk

c. If a portfolio's excess returns are regressed against its benchmark's excess returns, and the regression intercept is assumed to be the portfolio's alpha, then the correct denominator for its information ratio is the residual risk

d. If the minimum acceptable return (MAR) is set to equal the risk-free rate, then the Sortino ratio is equal to the Sharpe ratio

Answers here:

Last edited: