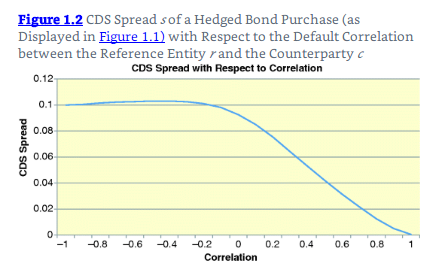

In the Meissner's chapter-1: Correlation Basics, there is a graph that shows the relationship between Correlation and Spread.

"we observe that for a correlation of -0.30 and higher, the higher the correlation, the lower the CDS spread. This is because an increasing r means a higher probability of the reference asset and the counterparty defaulting together."

Should not the spread be higher when correlation is higher owing to the increased risk? If it is, why is that spread is lower in this case?

Secondly, does correlation higher than 0 (positive side) mean that the CDS issuer (BNP Paribas) and the Sovereign country (Spain) debt, don't default together. As the graph indicates, above 0 correlations seems to bring the spread down. Why is that?

"we observe that for a correlation of -0.30 and higher, the higher the correlation, the lower the CDS spread. This is because an increasing r means a higher probability of the reference asset and the counterparty defaulting together."

Should not the spread be higher when correlation is higher owing to the increased risk? If it is, why is that spread is lower in this case?

Secondly, does correlation higher than 0 (positive side) mean that the CDS issuer (BNP Paribas) and the Sovereign country (Spain) debt, don't default together. As the graph indicates, above 0 correlations seems to bring the spread down. Why is that?