You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

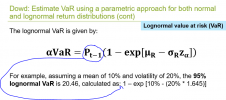

Lognormal VaR formula on FR_T5_pq_final video lesson

- Thread starter Randy Moon

- Start date

-

- Tags

- lognormal var

Hi @Randy Moon In the lognormal formula P(t-1) is simply the price base and it can be included/excluded (like any VaR) depending on whether we seek the return (%) or the dollar ($) VaR. In the example, where μ = 10% and σ = 20%, we can say that the 95% lognormal VaR is given by 1 - exp(10% - 20% * 1.645) = 20.467% (as shown, although it should have a "%"). Alternatively, if yesterday's price was, P(t-1) = $100 then the 95% lognormal VaR can be given by $100.00 * [1 - exp(10% - 20% * 1.645)] = $20.4647. Sometimes yesterday's price, P(t-1), is also represented by wealth, W(0). Hope that's helpful,

Randy Moon

New Member

Excellent. Thank you.

Similar threads

- Replies

- 1

- Views

- 949

- Replies

- 0

- Views

- 70

- Replies

- 0

- Views

- 474

- Replies

- 3

- Views

- 746