christylee

New Member

I bought the garp book for part 2 and found out that the part "in range of practices and issues in economic capital framework" is quite deep and vast I mean there are so many pages in the garp book to study for that topic while the study notes bionicturtle has provided has only 20 pages. Is it enough to only study the study notes for this topic? I am worried because some parts of that topic in the book are not found in the study notes.

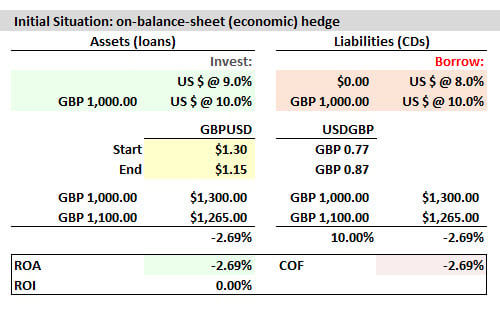

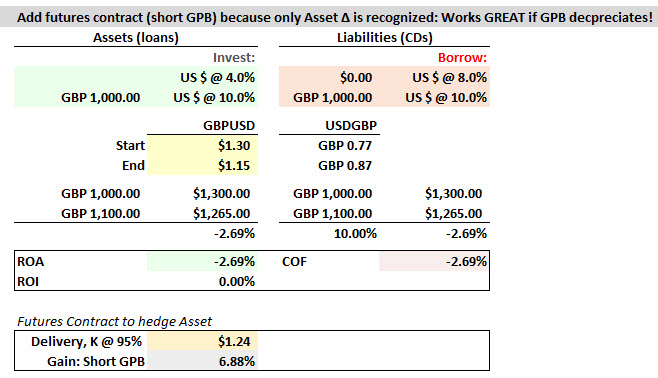

forward contracts go both ways, uh oh. If the GBP instead appreciates (as below, to $1.45), the accounting is still fine (left hand side only), but the economic (total) situation is worse. I think that's what he means. Here is my XLS:

forward contracts go both ways, uh oh. If the GBP instead appreciates (as below, to $1.45), the accounting is still fine (left hand side only), but the economic (total) situation is worse. I think that's what he means. Here is my XLS: