Suzanne Evans

Well-Known Member

FRM Fun 9 (S&P 500 Index in strange backwardation)

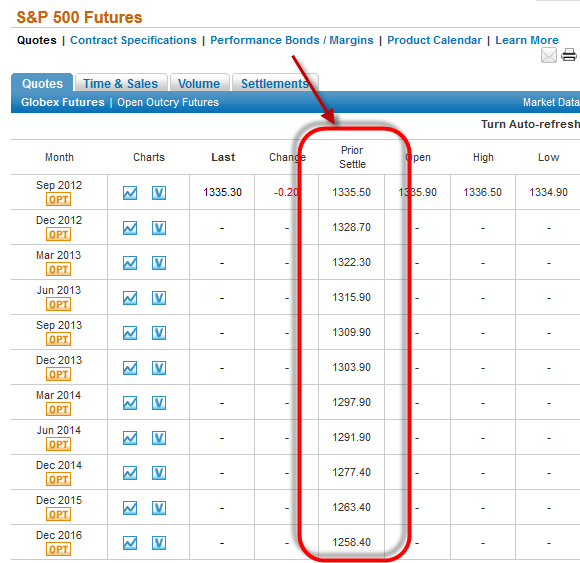

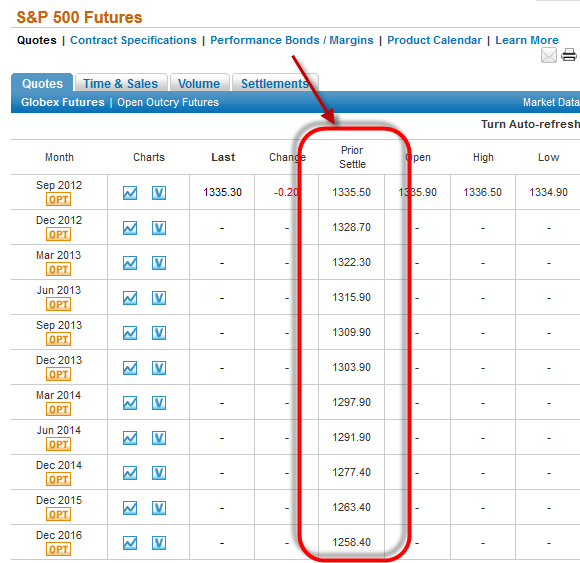

Yesterday, while writing the daily technical question, I looked up the prices for S&P 500 Index futures at http://www.cmegroup.com/. I was surprised to see the future curve in backwardation, I can't recall observing an investment commodity in backwardation (consumptions commodities, on the other hand, often are). Here is a snaphot:

Question: What can explain this? Is not there an obvious arbitrage?

As this is FRM prep, the best answer should address the cost of carry model contained in Hull and McDonald, which in theory should govern commodity forward curves (e.g., is consistent with, violates, doesn't apply because).

Yesterday, while writing the daily technical question, I looked up the prices for S&P 500 Index futures at http://www.cmegroup.com/. I was surprised to see the future curve in backwardation, I can't recall observing an investment commodity in backwardation (consumptions commodities, on the other hand, often are). Here is a snaphot:

Question: What can explain this? Is not there an obvious arbitrage?

As this is FRM prep, the best answer should address the cost of carry model contained in Hull and McDonald, which in theory should govern commodity forward curves (e.g., is consistent with, violates, doesn't apply because).