FRM Fun 11.

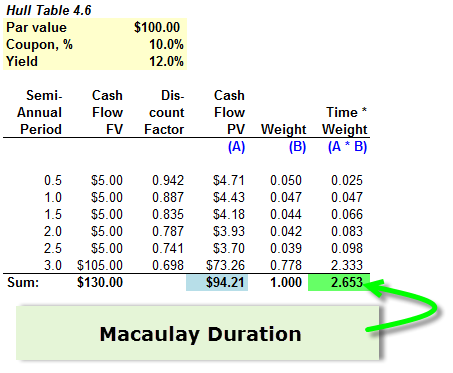

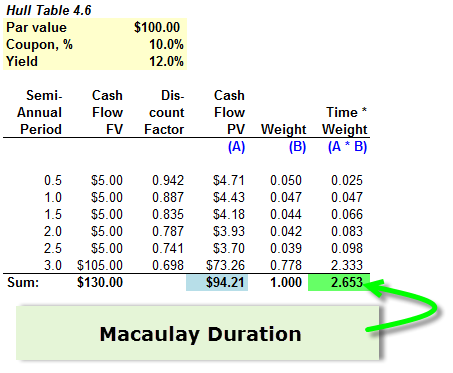

The Macaulay duration is the weighted average maturity of a bond, where the weights are the present values (as a percentage of the bond's price) of the cash flow. Hull's Table 4.6 below illustrates this nicely; the Macaulay duration of his 3-year bond is 2.653 years, which the sum of the right-hand column values, each of which is the product of a PV cash flow and its weight.

Questions (please do not conduct a forum search, as these questions summarize years of forum threads!):

The Macaulay duration is the weighted average maturity of a bond, where the weights are the present values (as a percentage of the bond's price) of the cash flow. Hull's Table 4.6 below illustrates this nicely; the Macaulay duration of his 3-year bond is 2.653 years, which the sum of the right-hand column values, each of which is the product of a PV cash flow and its weight.

Questions (please do not conduct a forum search, as these questions summarize years of forum threads!):

- As Macaulay Duration is the bond's weighted average maturity, we comfortably express Mac duration in years; e.g., Macaulay duration of 2.653 years. So much that, upon reading (for example) "bond duration of 7.0 years" the connotation is Macaulay.

But what are the UNITS of modified duration and why? - What is the difference between Macaulay duration, modified duration and effective duration; especially effective duration? (Best answers are brief but mathematically precise and decisive)