Johnny Firpo

Member

Hi,

I just got confused concerning "to be long or short a CDS".

Is this correct?

"Long CDS" means to be the protection buyer (which is equivalent to be short the bond)

"Short CDS" means to be the protection seller (which is equivalent to be long the bond)

Is the same true for a CDS Index?

"Long CDS Index" means to be the protection buyer (which is equivalent to be short the bonds)

"Short CDS Index" means to be the protection seller (which is equivalent to be long the bonds)

Thanks in advance!

I just got confused concerning "to be long or short a CDS".

Is this correct?

"Long CDS" means to be the protection buyer (which is equivalent to be short the bond)

"Short CDS" means to be the protection seller (which is equivalent to be long the bond)

Is the same true for a CDS Index?

"Long CDS Index" means to be the protection buyer (which is equivalent to be short the bonds)

"Short CDS Index" means to be the protection seller (which is equivalent to be long the bonds)

Thanks in advance!

)

)

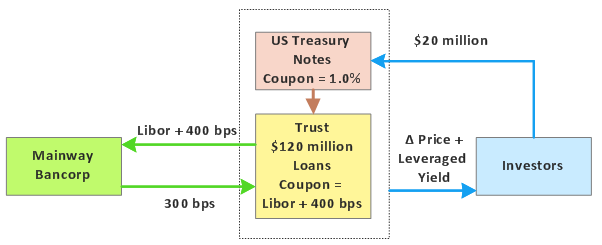

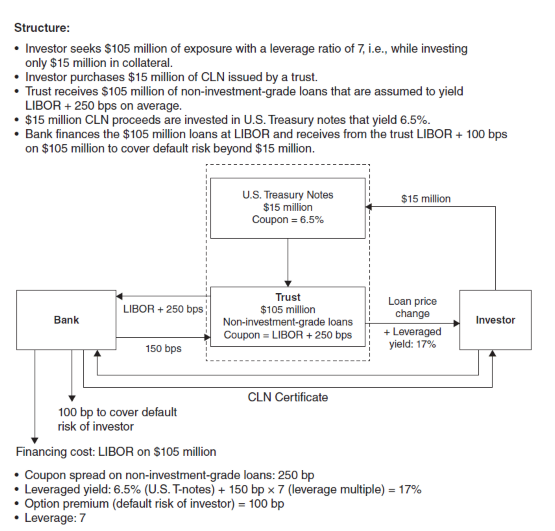

In regard to Crouhy's Figure 12-7, as the total notional is $105.0 mm with investors buying a CLN for $15.0, the structure is:

In regard to Crouhy's Figure 12-7, as the total notional is $105.0 mm with investors buying a CLN for $15.0, the structure is: