Hi

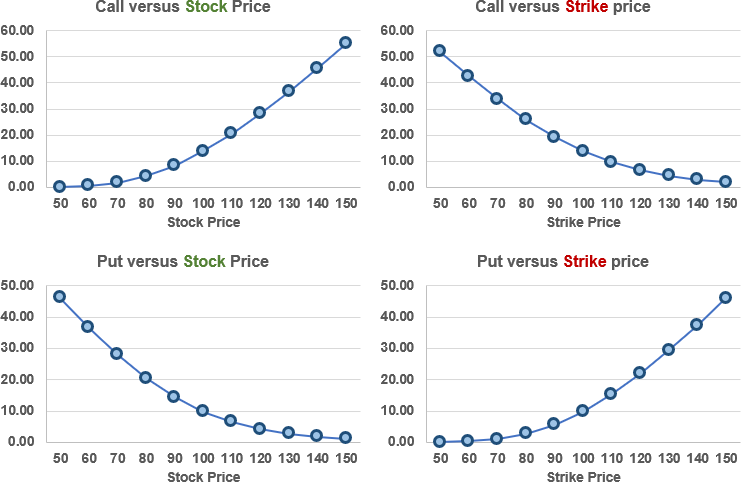

P1 Book3 Chapter 14 Page 176 says "Under any model, the price of a call option is always a convex function of the Strike Price" and then it shows Figure 14.6 where as the Strike price increases (X Axis), the call price increases (Y Axis). It would make sense if It's a convex function of the Stock Price but can someone provide an example to visualize Call Option being a Convex Function of the Strike Price. Does it imply that if Strike price increases so does the call price. If Strike price increases relative to the Stock Price, then Call option price decreases per BSM (tried few examples) -ie out of the Money Call- so the statement that Call price being a Convex function of the Strike price isn't very intuitive without examples. Any explanation or examples would be helpful.

P1 Book3 Chapter 14 Page 176 says "Under any model, the price of a call option is always a convex function of the Strike Price" and then it shows Figure 14.6 where as the Strike price increases (X Axis), the call price increases (Y Axis). It would make sense if It's a convex function of the Stock Price but can someone provide an example to visualize Call Option being a Convex Function of the Strike Price. Does it imply that if Strike price increases so does the call price. If Strike price increases relative to the Stock Price, then Call option price decreases per BSM (tried few examples) -ie out of the Money Call- so the statement that Call price being a Convex function of the Strike price isn't very intuitive without examples. Any explanation or examples would be helpful.