Dipti today asked a follow-up to this 2010 GARP Practice exam sample question:

I solve these by relying on the positive/negative sign (+/-). The only hard part, for me, is memorizing that a positive discounted cash term [+K*exp(-rT)] signifies a long bond (to lend cash).

Put-call parity says that today's protective put (long put + long stock) must equal a long call plus a long bond. But focus on the signs (+/-): +p +S = +c +K*exp(-rT).

+c = long call, +S is long Stock, +p = long put and +K*exp(-rT) = long bond (lend cash). On the other hand, (-c) = short call, (-S) = short stock, and [-K*exp(-rT] = short bond (borrow cash).

Here is a practice example. If we solve put-call parity for S, we get +S = +c -p +K*exp(-rT);

i.e., a long stock position in synthesized with a long call (+c) & a short put (-p) & a long bond (+K) with face value of discounted strike price.

For the above, we can solve for either (p) or for (c):

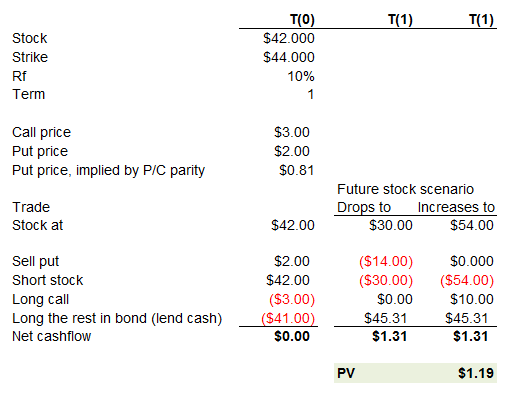

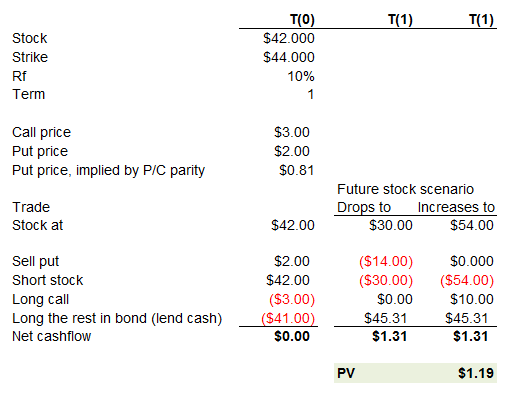

Question: The current price of stock ABC is USD 42 and the call option with a strike at USD 44 is trading at USD 3. Expiration is in one year. The put option with the same exercise price and same expiration date is priced at USD 2. Assume that the annual risk-free rate is 10% and that there is a risk-free bond paying the risk-free rate that can be shorted costlessly. There are no transaction costs. Which of the following trading strategies will result in arbitrage profits?

a. Long position in both the call option and the stock, and short position in the put option and risk-free bond.

b. Long position in both the call option and the put option, and short position in the stock and risk-free bond.

c. Long position in both the call option and risk-free bond, and short position in the stock and the put option.

d. Long position in both the put option and the risk-free bond, and short position in the stock and the call option.

I solve these by relying on the positive/negative sign (+/-). The only hard part, for me, is memorizing that a positive discounted cash term [+K*exp(-rT)] signifies a long bond (to lend cash).

Put-call parity says that today's protective put (long put + long stock) must equal a long call plus a long bond. But focus on the signs (+/-): +p +S = +c +K*exp(-rT).

+c = long call, +S is long Stock, +p = long put and +K*exp(-rT) = long bond (lend cash). On the other hand, (-c) = short call, (-S) = short stock, and [-K*exp(-rT] = short bond (borrow cash).

Here is a practice example. If we solve put-call parity for S, we get +S = +c -p +K*exp(-rT);

i.e., a long stock position in synthesized with a long call (+c) & a short put (-p) & a long bond (+K) with face value of discounted strike price.

For the above, we can solve for either (p) or for (c):

- p = c - S + K*exp(-rT);

long put (+p) should = long call (+c) & short stock (-S) & long bond (+K is lend cash), or - c = p + S - K*exp(-rT)

long call (+c) should = long put (+p) & long stock (+S) & short bond (-K is borrow cash)

- p should = 3 - 42 + 44*exp(-10%*1) = $0.81 but trades higher at 2.00, p trades rich so we should sell the put

- c should = 2 + 42 - 44*exp(-10%*1) = $4.19 but trades lower at 3.00, c trades cheap so we should buy the call

- On discovering the put(p) trades rich, we sell the left side (rich put) and buy the right side, letting (+) signify buy and negative (-) signify sell:

-[p] = +[c - S + K*exp(-rT)] --> -p = +c -S +K*exp(-rT) - Or, on discovering the call(c) trades cheap, we buy the left side and sell the right side:

+[c] = -[p + S - K*exp(-rT)] --> +c = -p -S +K*exp(-rT)

- sell the (rich) put (-p),

- buy the (cheap) call,

- short the Stock (-S), and

- lend cash (long the bond, due to -K). If it were instead positive [+K*exp(-rT)] then we should short the bond (borrow cash)